How To Invest To Retire Early | Part 1 of 2

In the aftermath of the Global Financial Crisis in 2008, many European countries, facing budget shortfalls, adopted austerity measures to tackle their fiscal deficits. Austerity measures are belt-tightening measures taken by governments to balance their budgets. This typically involves cutting spending and/or increasing revenue.

For example, Greece – one of the countries in the European Union in the worst financial position – cut expenses by increasing the retirement age from 65 to 67 years, salary and pension cuts, and tax increases.

The problem with austerity measures is that revenue is limited. With taxes being the principal source of income, a country can only raise taxes so much before it becomes counterproductive and slows down the economy.

Austerity is not a position any country wants to be in and it’s not a position any potential retiree wants to be in either.

Nobody wants to be entering retirement facing a budget shortfall and having to take austerity measures just to get by. Nobody imagines spending retirement cutting expenses and scrambling for ways to increase revenue. There are many things retirees would rather be doing than pinching pennies while working shifts at McDonald’s.

You become financially free when your passive income exceeds your expenses. – T. Harv Eker

The key to avoiding austerity and having to rely on a single source of income is to create additional streams of income – passive income because there are only so many hours in a day.

You’ve heard the old cliche for retirement planning: Spend less and make more so you have more to save for retirement.

I can go along with this plan, but the biggest mistake most people make is what they do with their savings.

The current rule of thumb is that you should have about $1 million to just make it through retirement. That’s just to make it through. But don’t you want to be able to visit and spoil your grandkids on both coasts, visit ancient ruins and donate your time and money to your most cherished causes?

To be financially independent, you should have closer to $3 million than the recommended $1 million. That’s because as a general rule of thumb, you should build up a retirement war chest equal to 30 times your annual expenses. So if your annual expenses on food, cars, housing, clothing, travel, etc. are $100,000 per year, then you should have $3 million at retirement.

As you work towards that $3 million, $5 million, or higher goal, here are a few simple suggestions:

SPEND SMART. There are productive assets and there are destructive assets. Productive assets like the right investments grow capital while destructive assets like expensive cars, fancy clothes, and excessive toys only take away from your capital.

IMPRESS OTHERS LATER. You’re only hurting yourself by acquiring destructive assets to impress your friends and neighbors. Better to impress them later with all the free time you have because of the productive assets you accumulated in your younger days that allow you to do the things you want now.

SAVE AT LEAST 4% OF YOUR TAKE-HOME PAY. 4% is the starting point. You should incrementally increase your savings rate of 0.5% each year to accelerate reaching your retirement goals. Saving alone will not guarantee your ideal retirement, however. How you invest those savings will determine whether you end up greeting customers at a Walmart or greeting the rising sun over a white sandy every morning.

INVEST FIRST. Spend first-dollar gains towards investments instead of non-essential expenses.

BUY LUXURIES WITH INVESTMENT INCOME. Only when your passive income exceeds your expenses should you splurge on luxuries.

A Word About Passive Investments.

It doesn’t matter how much you save if you’re allocating your assets to the wrong investments. Forget traditional fixed-income investments like bonds, treasuries, annuities, CDs, money market accounts, and savings accounts.

None of those are going to pay more than the 3.22% annual inflation rate (based on a 20-year average), which means you’ll be losing money by putting your money in those so-called investments.

Emulating the investing habits of sophisticated investors and their preference for certain passive investment classes will ensure the highest likelihood of your investing success.

What Passive Investments Should You Target?

Sophisticated investors like university endowments, family offices, and ultra-high-net-worth investors (“UHNWIs”) allocate nearly 30% of their investable assets in real estate. When combined with income-producing private equity, these sophisticated investors allocate more than 50% of their investable assets in those two asset classes – achieving returns over 11% annually.

The Numbers.

To get to your 30x expenses goal, there are some simple tweaks that you can make now to accelerate reaching your retirement goals quicker. As a general rule, you should start by saving 4% of your gross income for investment.

To reach financial independence quicker, I highly recommend increasing your annual contribution amount incrementally.

Let’s start with an example.

Example:

Assumptions:

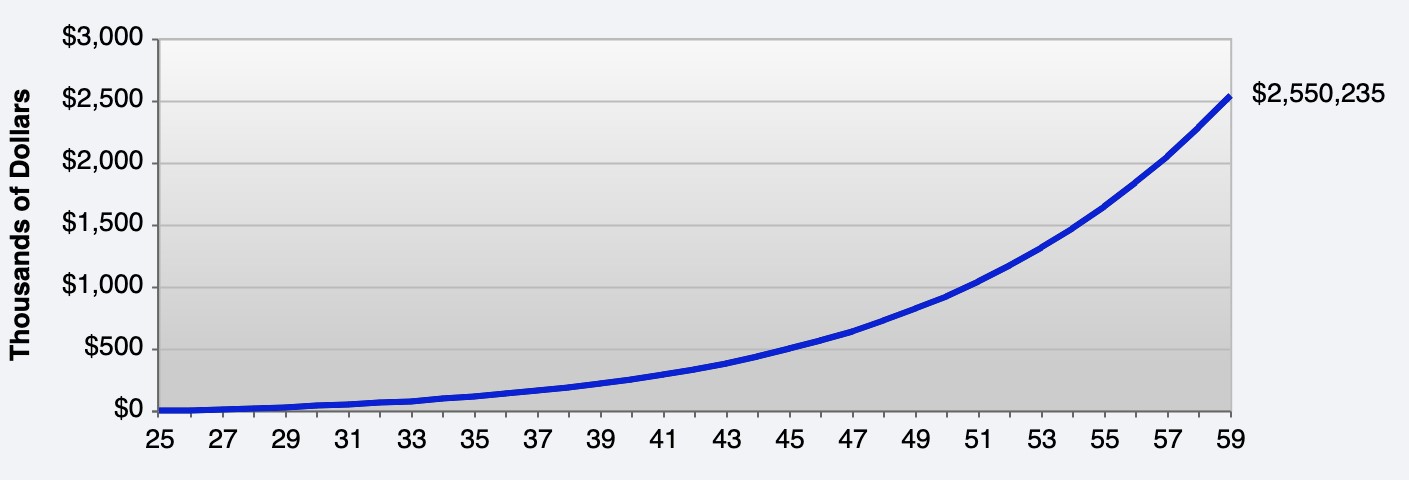

- Annual Salary: $120,000

- Annual Salary increase: 6%

- Current Age: 25

- Years until Retirement: 35

- Current Savings/Investment Rate: 4%

- Annual Rate of Return: 10%

If all you did was invest 4% of your annual gross income every year in a cash-flowing passive investment paying 10% annually, you can expect to have $2,550,235.

Now, here’s where it gets interesting…

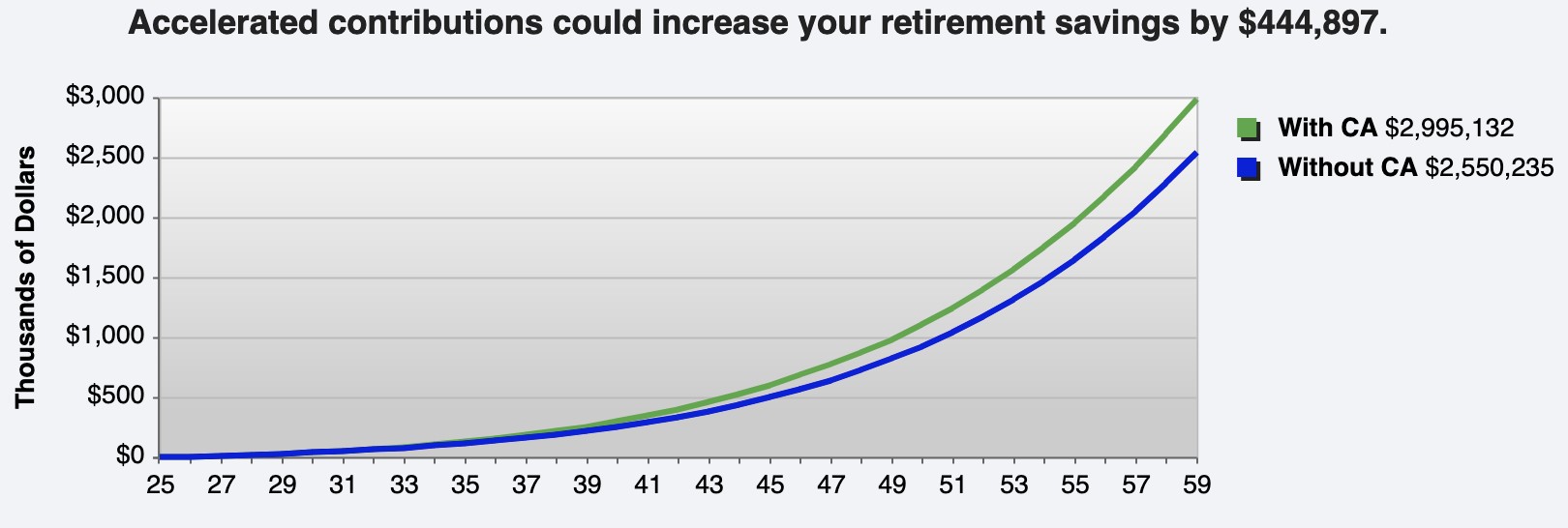

What if instead of sticking with your 4% savings/investment rule every year, you accelerated your contributions by say just .1%.

So in year 1, you invest 4% of your gross income, but in year 2, you’re investing 4.1%, and so on.

Here’s what accelerating your contributions by just 0.1% each year will do for your retirement:

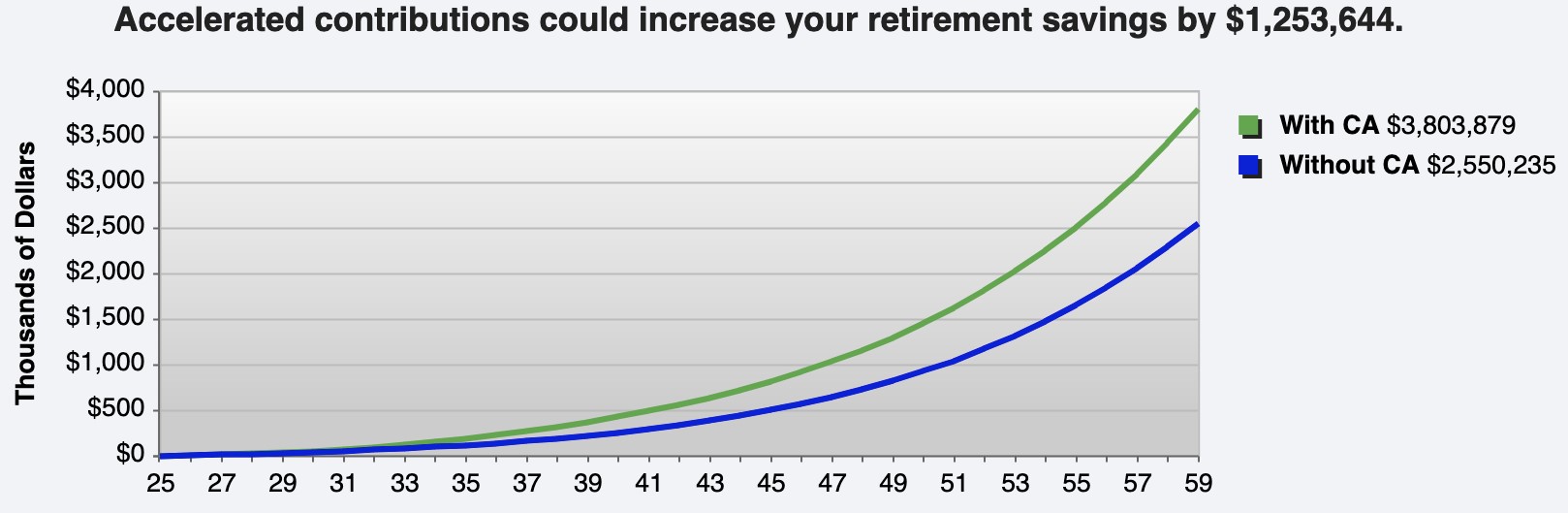

What if you accelerate your contributions by just 0.5% each year?

By accelerating your annual contributions by just .5% annually, you’ll have $1,253,644 more in savings at retirement age and you’ll be able to reach your milestone of $3 million a full 3 years sooner.

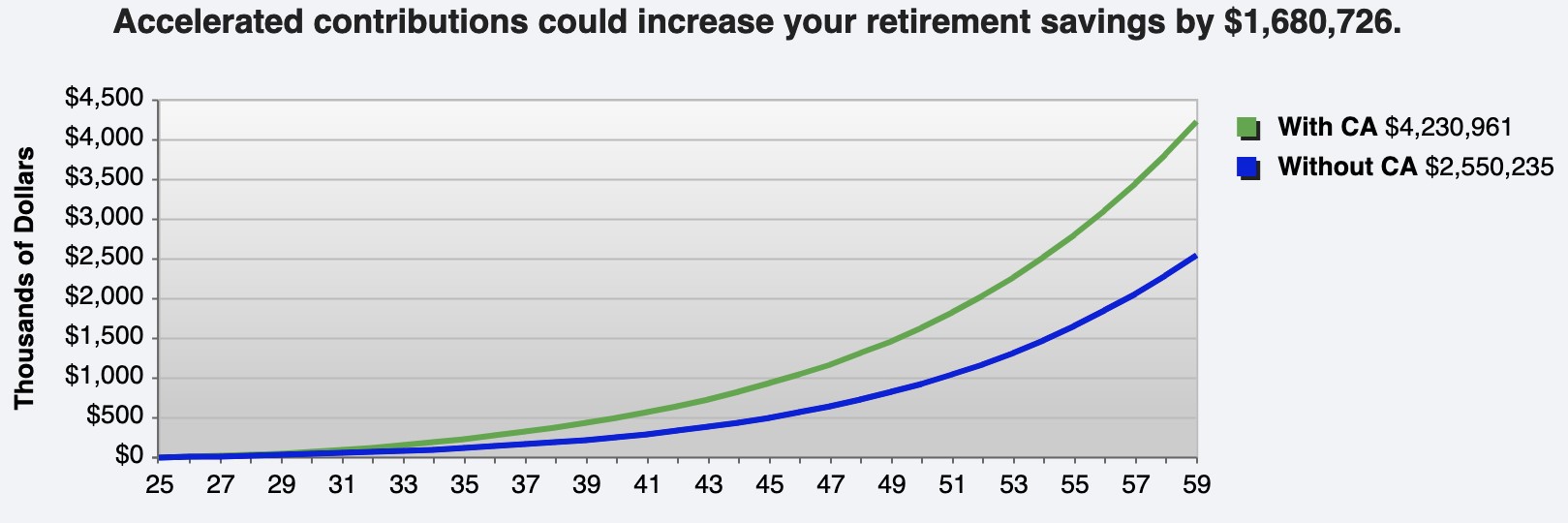

What if you accelerate your contributions by just 1% each year with a cap of 10%?

By accelerating your annual contributions by just 1% annually (capped at 10%), you’ll have $1,680,726 more in savings at retirement age and you’ll be able to reach your milestone of $3 million a full 4.5 years sooner.

I just showed you how a person making $120,000 a year can end up with $4,230,961 in retirement savings by the age of 60 if they started at the age of 25.

All it takes is investing in the right cash-flowing passive investments, starting by saving/investing 4% in the first year and increasing that amount by 1% each year.