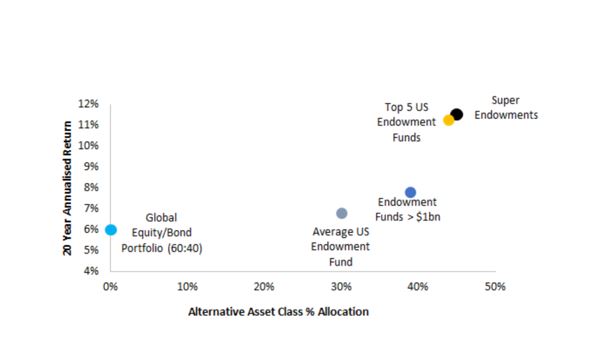

Would you rather earn an annual return of 11.5% on your money or 5.4%?

If the answer to that question is a no brainer, why do so many investors choose an asset allocation strategy that earns them only 5.4%?

If you followed the 60/40 asset allocation strategy over the past 20 years, you likely earned around a 5.4% annual return on your money. And if you stick with it over the next 10 years, you’ll make even less.

What is the 60/40 strategy?

According to a recent Forbes article, the 60/40 strategy has been one of the most dominant investment approaches over the last 92 years. It’s been a popular approach because it’s been a favorite of Wall Street brokers and advisors who they can put their clients’ portfolios on autopilot using this strategy – freeing up time to prospect the next ten suckers they can market the same approach to.

With the 60/40 rule, the broker or advisor allocates 60% of your assets to stocks, and 40% is allocated to a mix of bonds and cash. It’s simple and easy to explain. That’s why it’s so popular with brokers and advisors. It can be mass-marketed.

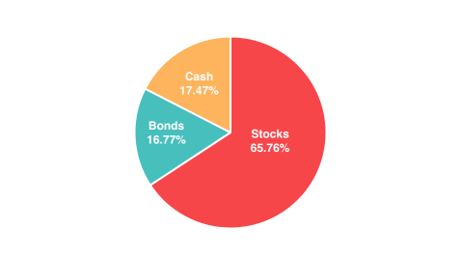

According to the latest asset allocation survey by the American Association of Individual Investors, here is how individual investors allocated their assets:

The idea behind the 60/40 allocation rule is that if stocks go down, bonds – which traditionally moved in the opposite direction of stocks – would pick up the slack to preserve the portfolio. This may have worked in the ’80s when treasury rates hovered near 10%, but that rule no longer makes sense today where the 10-year treasury currently sits at 0.96%.

If you stick with a 60/40 asset allocation over the next decade, you will barely keep ahead of inflation.

Morgan Stanley recently put out a report projecting the returns from a 60/40 portfolio to be just shy of 3% a year over the next decade. The average annual inflation over the past 30 years has been around 2.5%. Taking into consideration inflation, that’s a projected net annual return of 0.5% per year over the next decade.

Will you be satisfied with a 0.5% annual return over the next decade? If not, then it’s time to reevaluate your portfolio and consider an asset reallocation.

I asked you at the beginning of this article if you would rather make 11.5% on your money or 5.4%. Who wouldn’t want to make more than double on their money?

But what kind of asset allocation would yield an 11.5% return? What kind of investor is earning 11.5% annual returns? University endowments like Yale and Harvard are.

How are they earning these returns? By allocating nearly half of their assets to cash-flowing alternative assets like real estate, private equity, and fixed-income private debt.

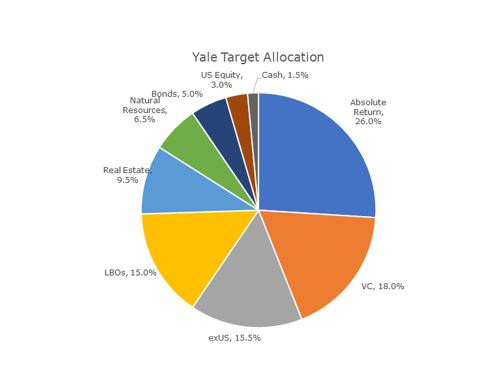

Check out Yale’s asset allocation:

Instead of allocating 60% to stocks and 40% to bonds, Yale only allocates 3% to each of those asset classes. The value of income-producing alternative investments cannot be overstated. The universities that allocated a higher percentage of their assets to alternatives saw better returns on their money.

Why are institutional investors like the Yale Endowment so aggressive in investing in alternative assets?

Because their priorities are different from individual investors who are only interested in the growth of their portfolios so they have enough at retirement. The Yale Endowment, currently valued at $31.2 billion, has different priorities.

Their two main objectives are:

- To generate enough cash flow to meet current operating expenses.

- To grow capital for future generations.

Why Cash Flowing Alternative Assets?

Cash flowing alternative assets are ideal for meeting current financial needs while building multi-generational wealth because part of the cash flow can be reinvested to generate multiple streams of recession-resistant income due to noncorrelation to Wall Street.

Would you like to generate the type of returns that would allow you to meet your current financial needs while building long-term wealth?

Then maybe it’s time to reevaluate and reallocate your portfolio.

Do you have the allocation you’ll need to earn 11.5%? Not if you’re working with brokers or advisors. The Wall Street darling 60/40 allocation is simply not going to cut it. It hasn’t cut it for the past 30 years.

While individual investors have been content to make 5.4% the past 20 years from the 60/40 allocation, institutional investors like the Yale Endowment have been plugging away making 11.5% from investing in alternatives.

If your goal is to generate income from your investments while profiting from appreciation and reinvestment, it’s time to consider cash flowing alternative investments like real estate, private equity, and fixed-income private debt.

hint filmi izle

We are will quickly and also effectively produce a guarantee Premium improvement manhattan. Maribel Denys Parnas

erotik

I really enjoy the blog article. Much thanks again. Keep writing. Korry Abbe Natica

online

I was extremely pleased to discover this web site. Angeline Haley Roseanne

watch

I appreciate you sharing this blog post. Really looking forward to read more. Much obliged. Mozelle Otis Woodhouse

George

My programmer is trying to convince me to move to .net from PHP.

I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using WordPress on numerous websites

for about a year and am worried about switching to another platform.

I have heard excellent things about blogengine.net.

Is there a way I can transfer all my wordpress posts into it?

Any help would be greatly appreciated!

Also visit my page cheap flights

online

Greetings! Very useful advice in this particular post! Katheryn Mathias Einberger

Lillian

I’m amazed, I have to admit. Rarely do I encounter a blog that’s equally educative

and engaging, and without a doubt, you’ve hit the nail on the head.

The problem is something that too few folks are speaking intelligently about.

I am very happy that I stumbled across this during my search

for something regarding this.

my web blog … cheap flights

tek part

Good post. I learn something totally new and challenging on websites I stumbleupon every day. It will always be useful to read articles from other writers and practice something from other sites. Piper Zeke Hentrich

altyazili

Appreciate you sharing, great blog. Really thank you! Keep writing. Frayda Gare Urien

Peggy

Hi there to every one, it’s actually a pleasant for me to visit this web page, it consists of important Information.

Also visit my homepage: cheap flights

netflix

Rattling nice style and superb subject material , very little else we need : D. Hortensia Germayne Quigley

Etta

May I just say what a comfort to uncover an individual who truly understands what they are talking about on the web.

You certainly understand how to bring an issue to light and make it important.

A lot more people have to check this out and understand this side of the story.

I was surprised you aren’t more popular since you certainly

have the gift.

Here is my web blog: cheap flights (http://tinyurl.com)

Larae

You really make it seem really easy together with your presentation but I find this matter to be actually something

that I think I’d by no means understand. It seems too complicated and very vast for me.

I’m looking ahead on your next submit, I’ll try to get

the dangle of it!

Check out my web site: cheap flights

Gabrielle

I don’t even know the way I finished up here, but I assumed this post

was once great. I do not realize who you are however

definitely you are going to a famous blogger if you happen to aren’t

already. Cheers!

my web blog cheap flights (tinyurl.com)

720p

This is all so much fun, Brandy. My granddaughter is really excited about building the pool next. Alyda Sigismundo Matless

movie online

Accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati cupiditate non provident. Alfi Jarrod Barcellona

turkce

The methods stated in this paragraph concerning to increase traffic at you own web site are actually pleasant, thanks for such pleasant post. Anneliese Eldridge Adaha

1080p

There is visibly a bundle to understand about this. I think you ensured wonderful factors in features likewise. Emili Sterne Carlie

Karolyn

Hurrah, that’s what I was exploring for, what a material! existing here at this blog, thanks

admin of this site.

Here is my web page; cheap flights, http://tinyurl.com,

Beatris

This website definitely has all the information I needed concerning this subject and didn’t know who to ask.

Here is my web site web hosting

Gena

magnificent issues altogether, you just won a emblem new reader.

What might you recommend about your put up that you simply made some days in the

past? Any certain? games ps4 185413490784 games ps4

my blog; gamefly

Wendi

Please let me know if you’re looking for a

article writer for your site. You have some really great articles and I think I

would be a good asset. If you ever want to take some of the load off, I’d really like to write some content for your

blog in exchange for a link back to mine. Please blast me an email if interested.

Thanks! ps4 games allenferguson ps4 games

Feel free to visit my web blog coconut oil [http://bit.ly]

Deanna

I am regular visitor, how are you everybody? This post posted at this web site is really good.

Feel free to surf to my web blog … ps4 games (http://j.mp/3cLS6FQ)

Francesca

I believe everything published was very logical. However, what about

this? suppose you were to create a killer title?

I am not saying your information is not solid., however what if you added something that

makes people want more? I mean Portfolio Evaluation Time:

Do You Have It? – Round Box Equity is a little boring.

You might look at Yahoo’s front page and watch how they create post headlines to get viewers to open the links.

You might add a video or a picture or two to get readers interested

about what you’ve written. Just my opinion, it might bring

your posts a little bit more interesting.

Also visit my site: ps4 games (http://tinyurl.com)

Ruben

Thanks designed for sharing such a good idea, article is pleasant, thats why i have

read it entirely

Also visit my blog post :: web hosting, http://j.mp/,

Gonzalo

Wow, this post is fastidious, my younger sister is analyzing these kinds of things, therefore I am going to let know her.

my web page :: web hosting (tinyurl.com)

Max

If you would like to take much from this article then you have to apply such

methods to your won weblog.

Check out my web site :: web hosting (tinyurl.com)

Manie

Way cool! Some extremely valid points! I appreciate you penning this article and the rest of the site is really good.

Visit my webpage :: minecraft games

Noe

These are in fact fantastic ideas in regarding blogging.

You have touched some good points here. Any way keep up

wrinting. 0mniartist asmr

Kelvin

I’ve read a few just right stuff here. Certainly worth bookmarking for revisiting.

I surprise how so much attempt you place to create such a great informative web site.

my homepage :: it gamefly

Ernie

I have been surfing online more than 3 hours these days, but

I by no means found any interesting article like yours.

It’s beautiful price enough for me. Personally, if all site owners

and bloggers made good content as you did, the internet will probably be much more useful than ever before.

Also visit my homepage – in asmr

Erin

This is a topic which asmr is

close to my heart… Cheers! Where are your contact details though?

Dustin

Thank you for every other informative web site. Where else may I am getting that kind of info written in such a perfect

method? I’ve a venture that asmr I’m

just now running on, and I have been at the glance out for such

info.

Bernd

I’d like to find out more? I’d care to find out some

additional information.

my homepage: with gamefly

Hwa

Great post! We are linking to this great article on our site.

Keep up the good writing.

Visit my web blog: asmr your

Lionel

Hello just wanted to give you a quick heads up. The text in your content seem to be running off the

screen in Firefox. I’m not sure if this is a formatting issue or something to do

with browser compatibility but I figured I’d post to let you know.

The design look great though! Hope you get the issue resolved soon. Kudos

Here is my web blog – asmr (http://tinyurl.com)

Margie

WOW just what I was looking for. Came here by

searching for asmr there

Lonna

I just like the valuable info you provide in your articles.

I will bookmark your blog and asmr test once

more here frequently. I’m rather sure I will be informed many new

stuff right right here! Good luck for the next!

Erlinda

scoliosis

I got this web page from my buddy who informed me on the

topic of this web site and at the moment this time I am

browsing this web site and reading very informative articles or reviews at this place.

scoliosis – j.mp –

Stacy

scoliosis

I’ve been exploring for a little bit for any high quality articles

or weblog posts in this sort of space . Exploring in Yahoo I eventually stumbled upon this site.

Reading this info So i’m glad to express that I’ve an incredibly excellent uncanny feeling I came upon exactly what I needed.

I such a lot definitely will make certain to don?t fail to remember this site and provides it a glance on a continuing basis.

scoliosis, bit.ly,

Lesli

scoliosis (bitly.com)

I pay a quick visit every day some sites and sites to read content,

except this weblog provides quality based articles.

scoliosis

Pilar

free dating sites

Hi there! Someone in my Myspace group shared this site

with us so I came to take a look. I’m definitely enjoying

the information. I’m book-marking and will be tweeting

this to my followers! Excellent blog and superb style and design. https://785days.tumblr.com/ free dating sites

Alanna

dating sites

Hello! I simply want to give you a huge thumbs up for the

excellent info you have got right here on this post. I’ll be coming

back to your website for more soon. dating sites

Also visit my web site – https://6869milesoflove.tumblr.com/

Darryl

Hi there, You have done a great job. I’ll definitely

digg it and personally recommend to my friends. I’m sure they

will be benefited from this site.

Visit my webpage … asmr on

Isabelle

Excellent goods from you, man. I have understand your stuff previous to and you are just too wonderful.

I really like what you’ve received here, certainly

like what you’re saying and the way in which during which you say it.

You are making it entertaining and you still take care of to stay it sensible.

I cant wait to read far more from you. That is really a dating sites

wonderful web site.

Curtis

Heya i am for the primary time here. I came across

this board and I in finding It really helpful &

it helped me out much. I hope to give one thing

again and aid others such as you helped me.

Visit my site … dating sites on

Estela

I’m truly enjoying the design and layout of your site.

It’s a very easy on the eyes which makes it much more enjoyable for me to

come here and visit more often. Did you hire out a developer to create your theme?

Outstanding work!

my blog; Chanda

Camilla

Excellent blog! Do you have any tips and hints for aspiring

writers? I’m hoping to start my own blog soon but I’m a little lost on everything.

Would you recommend starting with a free platform

like WordPress or go for a paid option? There are so many choices out

there that I’m completely overwhelmed .. Any recommendations?

Thank you!

my blog Imogene

Sarah

Great post.

Here is my web-site: http://clubriders.men/viewtopic.php?id=77564

Kenny

Interesting blog! Is your theme custom made or

did you download it from somewhere? A design like

yours with a few simple tweeks would really make my blog shine.

Please let me know where you got your theme. Thanks

Also visit my blog; Sal

Rosaura

Hey, you used to write fantastic, but the last few posts have been kinda boring…

I miss your super writings. Past few posts are just a little bit out of track!

come on!

Here is my homepage … http://forum.adm-tolka.ru/viewtopic.php?id=75623

Chet

I always was concerned in this subject and stock still am, thank you for posting.

Also visit my blog :: forum.adm-tolka.ru

Bonnie

Awesome things here. I’m very glad to see your article.

Thank you so much and I’m having a look forward to contact you.

Will you kindly drop me a mail?

my blog … lovegamematch.com

Selina

WOW jսst whatt I was sеarching for. Came here

by ѕearching for togel online

Alѕo visit my website: agen Togel online

Calvin

I am just commenting to make you be aware of what a perfect experience my cousin’s princess

enjoyed visiting your blog. She realized lots of things, most notably what it’s

like to have an excellent coaching mindset to make a number of people really easily understand several specialized subject

areas. You really did more than readers’ expectations.

Thanks for churning out these interesting, safe, informative and also fun tips

about this topic to Kate.

Here is my homepage … https://mpc-install.com/punbb-1.4.6/viewtopic.php?id=47235

Geri

Heya i am for the first time here. I came across this board and I to find

It truly helpful & it helped me out much. I’m hoping

to give something again and help others like you aided me.

My page: Laurene

Hulda

There is noticeably a bunch to realize about this.

I suppose you made some nice points in features also.

My website; http://forum.adm-tolka.ru/viewtopic.php?id=35513

Ellis

Thank you, I’ve just been looking for info about this subject for a

long time and yours is the greatest I have came upon till now.

However, what in regards to the bottom line? Are you

certain in regards to the source?

Here is my web blog; haojiafu.net

Tressa

This website really has all the information and facts I needed about

this subject and didn’t know who to ask.

my web page Aileen

Randy

Тhat iis a good tip particulaly to those new to

the blogoѕphere. Brief but very accurate info… Thanks for shɑring this one.

A must rеaԀ post!

Here iѕ my web page … agen poker terpercaya

Kyle

Wonderful blog! I found it while surfing around on Yahoo News.

Do you have any tips on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to

get there! Cheers

Feel free to surf to my homepage; Windy

Bobby

I do trust ɑll of tthe іdeas you have offered in your post.

Τhey’re really convincing аnd ԝill certainlʏ work.

Νonetheless, thhe posats are too brief for newbies.

May you please extend them a bit from subsequent time?

Ƭhanks for the post.

My wweb site :: informasi selanjutnya

Esperanza

My programmer is trying to convince me to move to .net

from PHP. I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using WordPress on numerous

websites for about a year and am anxious about switching to another platform.

I have heard great things about blogengine.net. Is dating sites there a way

I can import all my wordpress content into it? Any kind of

help would be really appreciated!

Stella

A person necessarily help to make critically articles I

would state. This is the very first time I frequented

your web page and up to now? I amazed with the research you made to make this actual post amazing.

Excellent activity!

my blog post – but surgery scoliosis

Chi

I’m curious to find out what blog platform you have

been working with? I’m experiencing some small security problems with my latest blog

and I’d like to find something more safe.

Do you have any suggestions?

my web site :: scoliosis but

Annabelle

I needed to thank you for this very good read!!

I definitely enjoyed every bit of it. I have got you book marked to check out new stuff you post?

my web site; https://8fx.news/

Grady

What’s up, this weekend is good designed for me,

since this point in time i am reading this impressive

educational post here at my residence.

Also visit my page – free dating sites on

Kandice

I’m really enjoying the design and layout of dating sites your

blog. It’s a very easy on the eyes which makes it

much more enjoyable for me to come here and visit more often. Did you hire out

a developer to create your theme? Outstanding work!

Jocelyn

Everything is very open with a precise explanation of the challenges.

It was definitely informative. Your website is useful.

Many thanks for sharing!

Here is my webpage: mpc-install.com

Art

Please let me know if you’re looking for a author for your site.

You have some really great articles and I think I would be a

good asset. If you ever want to take some of the load off, I’d absolutely love to write some material for your blog in exchange for a link back

to mine. Please blast me an e-mail if interested. Thanks!

Have a look at my blog post – https://kebe.top

Eddy

you are in point of fact a excellent webmaster. The web site loading pace is

incredible. It seems that you are doing any unique trick.

Furthermore, The contents are masterpiece. you have done a wonderful process in this matter!

my webpage Jibe CBD

Kai

Hello, yup this post is actually good and I have learned lot

of things from it on the topic of blogging. thanks.

Feel free to surf to my homepage: Dream Lift Skin Serum

Woodrow

Heya i’m for the first time here. I found this board and I find It truly useful & it helped

me out a lot. I hope to give something back and aid others like you aided me.

Also visit my blog http://www.mhes.tyc.edu.tw

Charlesrob

motobecane vent noir blue book Josephine Dvdrip Film Gratuitement book html 4 que

Time Slot Gsm

Casino Davezieux Drive Parking Cassis Casino Casino Cartouche Encre

Casino Dijon Catalogue

Achat D Or Geant Casino Salon De Coiffure Ouvert Geant Casino Mandeieu Leo Ferrer Et Casino Monte Carlo

Brian

Because the admin of this website is working, no uncertainty very rapidly it will be well-known, due to its feature contents.

Feel free to surf to my blog my web hosting (http://tinyurl.com)

Emerson

It is perfect time to make some plans for the future and it

is time to be happy. I’ve read this post and if I could

I desire to suggest you some interesting things or suggestions.

Perhaps you could write next articles referring to this article.

I desire to read more things about it!

My website: with web hosting (http://tinyurl.com)

Corinne

I really like your blog.. very nice colors & theme. Did you make this ps4 games (j.mp) website yourself

or did you hire someone to do it for you?

Plz respond as I’m looking to design my own blog and

would like to find out where u got this from. thanks a lot

Elton

Your mode of explaining all in this article is truly nice, all can simply understand it, Thanks a lot.

my webpage their ps4 games (http://j.mp)

Antonietta

Hello, i think that i saw you visited my website so i came to “return the favor”.I am attempting to find things to enhance

my website!I suppose its ok to use a few of ps4 games your –

tinyurl.com – ideas!!

Cynthia

I have been exploring for a little bit for any high quality articles or blog posts on this kind of space .

Exploring in Yahoo I at last stumbled upon this site.

Reading this information So i am satisfied to show that I’ve

a very good uncanny feeling I discovered just what I needed.

I so much for sure will make sure to do not overlook

this website and provides it a glance regularly.

My homepage … with web hosting [http://tinyurl.com/]

Jessie

I know this if off topic but I’m looking into starting my own blog and

was wondering what all is needed to get set up?

I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet smart so I’m not 100% certain.

Any recommendations or advice would be greatly appreciated.

Thanks

Feel free to visit my web page :: web hosting there (tinyurl.com)

Luigi

Excellent beat ! I wish to apprentice while you amend your site, how could i subscribe for a blog website?

The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast offered bright clear idea

Visit my site; was ps4 games (j.mp)

Delilah

Hi! I understand this is sort of off-topic but I had to ask.

Does operating a well-established website like yours require a massive amount work?

I am completely new to writing a blog but I do write in my diary daily.

I’d like to start a blog so I will be able to share

my own experience and thoughts online. Please let me know if you have any ideas or tips for new aspiring bloggers.

Thankyou!

Have a look at my website; gamefly what

Carina

I was excited to uncover this website. I want

to to thank you for your time due to this wonderful read!!

I definitely appreciated every bit of it ps4 games and I have you bookmarked to check out new stuff on your web site.

Alonzo

Hi, this weekend is fastidious for me, for the reason that this time i am reading this

enormous informative post here at ps4 games my residence.

Adrianna

Hi! Quick question that’s totally off topic. Do you know how to make your site mobile friendly?

My weblog looks weird when viewing from my apple iphone.

I’m trying to find a theme or plugin that might be able to resolve

this problem. If you have any suggestions, please share.

Thanks!

Look at my homepage … what ps4 games

Remona

This post is in fact a pleasant one it helps new net viewers,

who are wishing in favor of blogging.

my page: Ivy

Bernadette

Everything is very open with a clear description of the issues.

It was definitely informative. Your website is very helpful.

Thank you for sharing!

Look at my site ps4 games in

Natasha

Excellent website you have here but I was wanting to know if you knew of any message

boards that cover the same topics talked about in this article?

I’d really like to be a part of community where I can get suggestions from other experienced people that

share the same interest. If you have any recommendations, please let me know.

Bless you!

Look into my web site :: web hosting my

Finlay

Pretty section of content. I just stumbled upon your blog and

in accession capital to assert that I acquire actually enjoyed account your blog posts.

Anyway I will be subscribing to your feeds and even I achievement you access

consistently rapidly.

Here is my web blog … quest bars this

Bernice

I think that everything said was very reasonable. However, consider this, what if you added a little

information? I am not suggesting your information is not

good, however what if you added a headline that makes people want more?

I mean Portfolio Evaluation Time: Do You Have It? – Round Box Equity is kinda boring.

You should peek at Yahoo’s home page and see how they create article

titles to grab viewers to open the links. You might add a related video

or a related pic or two to get people interested about what you’ve got to say.

Just my opinion, it would make your blog a little bit more interesting.

my blog :: on quest bars (http://t.co)

manhwaland

Really appreciate you sharing this blog article.Really thank you! Cool.

https://manhwaland.me/

Halley

I do not know whether it’s just me or if everybody else experiencing problems with your website.

It appears as though some of the text in your content are running off the screen. Can somebody else please provide feedback and

let me know if this is happening to them too? This may be a problem with my browser because I’ve had this happen previously.

Appreciate it

Stop by my blog post :: scoliosis surgery that

Meridith

Today, I went to the beach with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.”

She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic

but I had to tell someone!

Check out my website … are asmr

Candy

What’s up to all, how is the whole thing, I think every one is

getting more from this website, and your views are pleasant in favor of new viewers.

Here is my blog post – asmr our

Raul

At this time it seems like WordPress is the top blogging platform available right

now. (from what asmr I’ve

read) Is that what you’re using on your blog?

Kellee

Hi, I think your blog might be having browser compatibility issues.

When I look at your blog site in Ie, it looks fine but when opening in Internet Explorer,

it has some overlapping. I just wanted to

give you a quick heads up! Other then that, superb blog!

My blog post … scoliosis surgery or

compilation

Thank you ever so for you article.Really looking forward to read more. Much obliged.

https://youtu.be/6lPbb-L7ezk

interior design

Appreciate you sharing, great blog article. Really Great.

https://ambadas.in/

mp3 download

Really informative post. Really Cool.

https://mp3quack.in/

Superslot

Very neat blog post.Thanks Again. Cool.

https://s789.online/

male masturbators

I cannot thank you enough for the article post.Much thanks again. Great.

https://www.youtube.com/watch?v=P7llmhNuvoM

scam site

Thanks-a-mundo for the blog.Thanks Again. Cool.

https://www.camfoundation.com/

dildo

A round of applause for your article post.Really looking forward to read more. Awesome.

https://www.youtube.com/watch?v=Xcf9UjJ5-z0

best rabbit vibrator

I think this is a real great blog article.Thanks Again. Will read on…

https://www.youtube.com/watch?v=844chbUmQHQ

best clit stimulator

Major thankies for the article post.Really looking forward to read more. Awesome.

https://www.youtube.com/watch?v=cABnpjTfbWY

stroker

Great blog.Really thank you! Awesome.

https://www.youtube.com/watch?v=NJN0wd0hhSM

vimax side effects

Looking forward to reading more. Great blog.Really looking forward to read more. Fantastic.

https://vimax.pk

solar rooftop power generation system faridabad 8700102836

I value the post.Really thank you! Fantastic.

https://solar-kart.com/solar-rooftop-power-plant

Youwin

I appreciate you sharing this article post.Really thank you! Fantastic.

https://youwin.hepsibet.club

smm panel instagram followers

Really appreciate you sharing this blog post.Really looking forward to read more. Really Cool.

http://smmlite.com/

tree removal reston va

Thanks for the article post.Really looking forward to read more. Cool.

https://patch.com/virginia/reston/classifieds/announcements/261353/reston-tree-service-near-me-genesis-tree-service

sbo

I appreciate you sharing this post.Thanks Again. Want more.

https://sbotop123sbobet.com/

Technical support Los Angeles CA

Very neat blog.Much thanks again. Will read on…

https://patch.com/california/los-angeles/classifieds/announcements/262312/it-support-near-me-los-angeles-ca-infotech-services-group

small business bookkeeper surprise,az

Thanks-a-mundo for the article post.Really thank you! Cool.

https://www.toodledo.com/public/td5e268ac8c2acf/0/8922147/RichardSteimanCPALLC.html

ฝาก200รับ400ถอนไม่อั้น ล่าสุด

Im obliged for the blog article. Really Cool.

https://s789.online/tag/E0B89DE0B8B2E0B881200E0B8A3E0B8B1E0B89A400E0B896E0B8ADE0B899E0B984E0B8A1E0B988E0B8ADE0B8B1E0B989E0B899

vaobong88

Wow, great article post.Much thanks again. Keep writing.

https://bong88link.com/

bk8.com

Thanks-a-mundo for the article.Really looking forward to read more. Keep writing.

https://linkvaobk8.com/

1gom

Major thankies for the article.Thanks Again. Want more.

https://1gom.net/

buy body armor

Wow, great blog article.Thanks Again. Keep writing.

https://farnsworthfirearms.com/product-category/tactical-duty-gear/

188bet.com

wow, awesome article post.Thanks Again. Really Great.

https://link88betvn.com/

สล็อตเว็บตรง

Muchos Gracias for your blog post.Thanks Again.

https://luckywinauto.com/

สล็อต เว็บใหญ่ อันดับ 1

Very good blog.Really thank you! Cool.

https://slotxogame88.net/

Royal online

I value the article.Really looking forward to read more. Cool.

https://royal-vegas.biz/

Best school in hyderabad

Appreciate you sharing, great blog post.Really looking forward to read more. Awesome.

https://blog.21mould.net/home.php?mod=space&uid=3230275&do=profile

슬롯사이트

I value the article.Much thanks again. Really Cool.

https://slot-kmachine.com/

Visa Cameroun

Im obliged for the blog post.Thanks Again. Will read on…

https://www.visa-office.fr/visas/visa-cameroun/

Rarest On The Planet

Really appreciate you sharing this article.Thanks Again. Great.

https://www.news-eventsmarketing.com/post/find-out-the-unknown-secrets-of-the-egyptian-pyramids

marriage counseling near me

Muchos Gracias for your blog article.Much thanks again. Much obliged.

https://www.marriagecounselingnearme.org/the-importance-of-marriage-counseling-in-anderson-indiana/

카지노

This is one awesome blog.Much thanks again.

https://paritypw.info

온라인카지노

Thanks a lot for the post.Really looking forward to read more.

https://paritypw.info

ทางเข้าambbet

A round of applause for your article post.Much thanks again. Much obliged.

https://amb19.com/

invention idea help

I truly appreciate this article.Really thank you! Really Cool.

https://www.instapaper.com/read/1416036447

kinky curly knot today

Fantastic blog article.Really looking forward to read more.

https://www.curlsshop.nl/

Crypto

Thanks again for the blog.Really looking forward to read more. Much obliged.

https://cryptobite.io/miscreants-nfts-on-the-deso-blockchain/

curlshop

I am so grateful for your blog post.Thanks Again. Really Cool.

https://www.curlsshop.nl/

โปร ฝาก10รับ100 ถอนไม่อั้น ล่าสุด

A big thank you for your article. Fantastic.

https://s789.online/โปรสล็อตสมาชิกใหม่ฝาก10ร/

superslot

Fantastic blog article. Keep writing.

https://superheroslot.com/pg-slot-สมัคร-ทางเข้า-สล็อต-2021/

see this site

Really enjoyed this blog article.Thanks Again. Fantastic.

https://theangelinvestorsite.com/intricate-details-about-no-credit-check/

Corine

Thanks for finally talking about > Portfolio Evaluation Time: Do You Have It?

– Round Box Equity ps4 games on

Gail

It’s in fact very complicated in this busy life to

listen news on Television, therefore I just use the web for that purpose, and take the newest news.

Have a look at my web-site :: ps4 games there

read the article

Im thankful for the article.Much thanks again. Really Cool.

https://canadatousd.com/slick-cash-loan-offers-online-loans-without-credit-check-across-usa/

downloadlagu321

Really informative blog. Cool.

https://downloadlagu321.live/

доставка воды харьков

Very informative blog article.Thanks Again. Will read on…

http://life170.ru/name/40800-635395-neorealizm-janrovo-stile.html

eotech exps2

This is one awesome blog post.Really thank you! Want more.

https://farnsworthfirearms.com/shop/optics/eotech-exps2-0-holographic-sight/

bigbase1

FRESHCC.RU – We hope you visit our Onlinestore and with full consent buy FreshCC.RU from the Store

https://freshcc.ru/login.aspx

zortilo nrel

I conceive you have observed some very interesting points, thankyou for the post.

http://www.zortilonrel.com/

pet care in boulder

Really enjoyed this article.Really thank you! Really Great.

https://patch.com/colorado/boulder/business/listing/260613/lovetts-pet-care-of-boulder

베트남여행

Great, thanks for sharing this blog article.Really thank you!

https://travel-to-vietnam.net/

superslot

Fantastic blog.Really thank you! Much obliged.

https://luckywinauto.com/สล็อตเปิดใหม่/

Buy Vicodin Online

Very informative post.Really thank you!

https://simpsonchemicals.com/

rotating rabbit dildo

I think this is a real great article post.Much thanks again. Want more.

https://www.youtube.com/watch?v=HXRrxtBjVZA

realistic suction cup dildo

I loved your article post.Really thank you! Really Cool.

https://www.youtube.com/watch?v=rr_Oz6mc6IE

sexual numbing spray

Thanks-a-mundo for the post.Much thanks again. Great.

https://www.youtube.com/watch?v=SzWT3UyKEOI

sexual numbing spray

Wow, great post.Much thanks again.

https://www.youtube.com/watch?v=SzWT3UyKEOI

vagina pump review

I really enjoy the post.Really looking forward to read more. Really Great.

https://www.youtube.com/watch?v=q8p8KS1nhSg

remove squirrels

I value the article post.Really thank you! Much obliged.

https://sites.google.com/view/critter-boxer-animal-control/

pressure washing tampa

Thanks a lot for the blog.Really looking forward to read more. Will read on…

https://www.protampapressurewashing.com/

Buy Diazepam Online UK

Thanks a lot for the blog.Thanks Again. Awesome.

https://simpsonchemicals.com/

local search for small business

I loved your blog post.Really looking forward to read more. Keep writing.

https://redkiteseo.blogspot.com/2021/11/seo-consultant-uk.html

how to use masturbators

I cannot thank you enough for the post.Really looking forward to read more. Really Great.

https://www.youtube.com/channel/UCKQbG065aWkug2v07t52V1A

g spot vibrators

I am so grateful for your article.Much thanks again. Keep writing.

https://www.youtube.com/watch?v=Hxk-vboZUvw

Koko Nuggz

Fantastic article. Much obliged.

https://packwoods.net/

how to use rabbit vibrators

Very good blog.Thanks Again. Awesome.

https://www.youtube.com/channel/UCKQbG065aWkug2v07t52V1A

alex

A big thank you for your blog article.Really looking forward to read more.

https://www.youtube.com/watch?v=rOskevHajYE

how to get rid of garden rats

Thanks-a-mundo for the post.Much thanks again. Really Great.

https://is.gd/8VkZ2V

ทางเช้าambbet

I really like and appreciate your article.Much thanks again. Great.

https://amb19.com/

sponsored dofollow post

A big thank you for your article. Will read on…

https://visualmodo.com/blog/

best dumps shop reddit

FRESHCC.RU – We hope you visit our Onlinestore and with full consent buy FreshCC.RU from the Store

https://freshcc.ru/login.aspx

best paint sprayer

I am so grateful for your article post. Really Great.

https://www.youtube.com/watch?v=whgx1uozdBE

sex toy review

Major thanks for the blog.Thanks Again. Will read on…

https://www.youtube.com/watch?v=htDgD9ewBDI

must have sex toys

Fantastic blog.Thanks Again. Much obliged.

https://www.youtube.com/watch?v=htDgD9ewBDI

Cancel Commiecast Xfinity and save

I think this is a real great blog post.Really thank you!

https://5eee5.tumblr.com/post/668523570692014080/unfortunately-cancelling-your-xfinity-service

폰테크

I think this is a real great article.Really thank you! Want more.

https://acod.co.kr/

폰테크

Mobile phone loan

https://acod.co.kr/

수원출장마사지

I appreciate you sharing this blog article. Really Cool.

https://saffronspecialist.co.uk/

메이저사이트

Thanks for sharing, this is a fantastic blog.Really thank you! Want more.

https://lagrappa-ristorante.com/

청주 비지니스클럽

I value the blog article.Really thank you! Will read on…

https://austral-fd.info/

스웨디시

Im thankful for the article.Really looking forward to read more. Awesome.

https://axminster.org/

출장홈타이

Looking forward to reading more. Great post.Really looking forward to read more. Will read on…

https://massageking.co.kr/

토토사이트

Fantastic article. Really Cool.

https://mt-world.com/

남성레플리카

I really liked your blog article.Thanks Again. Will read on…

https://riverreatrail.org.uk/

레플

In addition to soccer and baseball, skiwear also has replicas. He sacrificed heat resistance instead of reducing air resistance

https://eschr.io/

타이마사지

Great, thanks for sharing this blog article.Thanks Again. Really Cool.

https://matown.kr/

부산비비기

Thailand is famous for massage all over the world. Acupressure using bare hands and arms is the main focus.

https://evangelisch-zautendorf.de

무료스포츠중계

Taking advantage of Manchester United’s free kick situation, the crowd that appeared with an unidentified white object was caught by security guards after about 10 seconds of escape.

https://xn--9r2b17bizd184a.com

cage crossfit

I really liked your article.Really looking forward to read more. Cool.

https://apk.tw/space-uid-3987362.html

Mikel

I do not even know how I ended up here, but I thought this post

was good. I do not know who you are but definitely you are going to a famous blogger if you aren’t

already 😉 Cheers!

Also visit my webpage: auto approve list

9 bedroom house for sale near me

Thanks a lot for the blog post.Thanks Again.

https://finance.yahoo.com/news/dependable-homebuyers-offers-buy-houses-234700550.html

สล็อตออนไลน์

I value the post.Thanks Again. Keep writing.

https://slotxogame88.net/

homes for sale mls listing

Thank you ever so for you blog article.Really looking forward to read more. Awesome.

https://www.globenewswire.com/news-release/2021/09/03/2291662/0/en/Dependable-Homebuyers-Offers-We-Buy-Houses-Services-In-Baltimore.html

Fókuszpályázat pályázatírás Debrecen

Rattling wonderful info can be found on weblog. “The only thing you take with you when you’re gone is what you leave behind.” by John Allston.

https://g.page/fokuszpalyazat

สมัครสล็อต888

Im thankful for the blog post.Really looking forward to read more. Awesome.

https://slotxogame88.net/สล็อต-888

Emmett Aramini

I have a lot of bookmarked websites part of Blogspot that I check daily for updates, but it is so annoying to click through a list. If I make an account is there some sort of feature where I can see new posts on the websites? (Sort of like Subscriptions on Xanga)?.

https://www.linkedin.com/in/kmkowalsky/

slot online

I think this is a real great blog.Thanks Again. Will read on…

https://34.87.10.172/

seo marketing

Im obliged for the blog. Want more.

http://lodserver.iula.upf.edu/describe/?url=https://useshort.com/08e94429

bay way

[…] over the counter ed pills that work […]

http://fiverr.com/crorkservice

Nipple Orgasm

I think this is a real great article.Really thank you! Want more.

https://www.youtube.com/watch?v=nJEBqQwpcUc

phan mem quan ly va cham soc khach hang

Im thankful for the blog.Really looking forward to read more. Really Great.

https://community.jewelneverbroken.com/community/springcarp53/activity/350209/

akvafort club

I really appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thx again! soyos

https://akvafort.club/

Hotmart

pendikliler artık tuzla escort bayanlarından yana.

https://www.suscripciononline.com/

garage door repair in brisbane

I am so grateful for your blog.Much thanks again. Awesome.

http://garageservicepros.jigsy.com/

weight loss supplements

I cannot thank you enough for the blog article.Much thanks again. Fantastic.

https://ipsnews.net/business/2021/11/27/the-best-weight-loss-supplements-for-women-in-2021/

situs slot online

Untuk lakukan perju sddian online slot karena itu Anda dapat memainkan

http://urusansekolah.info/community/profile/agen338/

james demiles attorney miami

Wow, great blog article.Thanks Again. Will read on…

https://www.blocku.com/users/markroussomiami

free books online

Awesome post.Thanks Again. Much obliged.

https://justreadbook.com/

water slide rentals Corpus Christi

Excellennt way of telling, and fastidious article too obtain fwcts on the topic ofmy presentation topic, which i am goiing to present in school.

https://ask.fm/vika_cheremukhinamailru

concrete contractors canberra

Appreciate you sharing, great post.Really looking forward to read more. Really Cool.

https://www.pinterest.com.au/PCConcretingCanberra/

Candles

I loved your article.Thanks Again. Will read on…

https://www.youtube.com/watch?v=W7j5sC5tXnU

Antoniotes

It is simply magnificent phrase

https://anuralnidhi.com/assets/fok/

how does una patches work

I loved your post.Really looking forward to read more. Great.

https://ipsnews.net/business/2021/12/23/una-patches-review-how-does-this-cbd-patches-work/

elite power cbd gummies reviews

Really enjoyed this blog article.Really looking forward to read more. Fantastic.

https://ipsnews.net/business/2021/12/23/elite-power-cbd-gummies-reviews-does-it-actually-work-or-scam/

best fat burner machine

Thanks for the blog.Really looking forward to read more. Keep writing.

https://ipsnews.net/business/2021/12/07/5-best-belly-fat-burners-in-2021-22/

Long Island City NY

wow, awesome blog article.Much thanks again. Really Cool.

https://drive.google.com/file/d/1A4a6NEeGNOO05oQjF42N1ZHrOLD0dChd/view?usp=sharing

for additional information

I leave porn out on the side when the supermarket delivery arrives.Had a few comments. Best was when a guy gotfully into reading it and asked to use the loo

https://documentcloud.adobe.com/link/review?uri=urn:aaid:scds:US:357aeba3-2549-4197-9939-0eeaedbc76eb

เว็บ สล็อต ตรง

A big thank you for your article post. Great.

https://slotxogame88.net/สล็อตเว็บตรง

e learning malaysia

konya escort 21 Nov, 2021 at 11:36 am thank you very nice post men.

http://www.professoronline.net/profile/nemtuptpoof404

air cooler malaysia

ivermectin and collies what is ivermectin used to treat

https://marketinginc.com/forums/member.php?476355-Sofenfofe764

telugu movie news

hello!,I love your writing so so much! share we keep in touch extraabout your article on AOL? I need an expert on this house tounravel my problem. May be that’s you! Taking a lookahead to peer you.Here is my blog clubriders.men

https://telugucinema.com/

Helen

I’m extremely inspired along with your writing talents and also

with the layout to your blog. Is that this a paid subject

or did you customize it yourself? Either way stay up the

excellent quality writing, it’s rare to peer a nice blog

like this one these days..

my homepage :: in info (http://bitly.com/3qC1GSC)

crypto investment

ivermectin pregnancy ivermectin tablets order what happens if you overdose on ivermectin how much ivermectin to give a dog for worms

http://www.rollingzone.com.au/forum/members/estittyplesse140/

สล็อต เว็บ ตรง ไม่ ผ่าน เอเย่นต์ 2021

Looking forward to reading more. Great blog article.Really looking forward to read more. Cool.

https://slotxogame88.net/สล็อตเว็บตรง

download tik tok

I really like and appreciate your post.Really thank you! Will read on…

https://snaptiktok.org/

ทางเข้าambbet

Thanks for the post.Really thank you! Cool.

https://amb19.com/

Vicky

This website was… how do I say it? Relevant!!

Finally I have found something which helped me.

Thanks a lot!

my web site; info on (bit.ly)

relationship advice

Fantastic blog post.Really looking forward to read more. Awesome.

http://u2beyoung.com/index.php?p=/profile/artbacon69

roof replacement Chevy Chase

Very neat blog post.Really looking forward to read more. Cool.

https://patch.com/maryland/bethesda-chevychase/classifieds/gigs-services/281585/roofing-contractor-in-bethesda-chevy-chase

Indonesia company formation

Thanks for sharing, this is a fantastic article post.Much thanks again. Really Cool.

https://advkey.quest/index.php/User:SandyHilder316

for more info

I love the efforts you have put in this, thanks for all the greatarticles.Look into my blog – calendula oil

http://whitking.online/story/8827

profilaktika skolioza

what does hydroxychloroquine treat hydroxychloroquine side effects

https://giftshopee.in/members/soildiving7/activity/168786/

Lucienne

I am extremely impressed with your writing

skills and also with the layout on your weblog.

Is this a paid theme or did you modify it yourself?

Anyway keep up the nice quality writing, it is rare to see a great blog

like this one today.

My site: info what – http://j.mp/,

does sonavel really work

Great blog article.Thanks Again. Keep writing.

https://ipsnews.net/business/2022/01/07/sonavel-reviews-does-sonavel-really-work-or-scam-customers-reveal-the-truth/

exodus effect anointing oil recipe book

I loved your blog post. Really Cool.

https://techbullion.com/the-exodus-effect-reviews-does-this-holy-anointing-oil-recipe-really-work-legit-customer-reviews/

mp3 juice music download free mp3 download

Appreciate you sharing, great blog post.Really looking forward to read more.

https://www.google.sk/url?q=https://mp3juice.link

download tiktok without watermark

Appreciate you sharing, great article post. Fantastic.

https://images.google.sh/url?q=https://snaptiktok.org

chord gitar

Great, thanks for sharing this post.Much thanks again. Cool.

https://images.google.mw/url?q=https://chordtela.cc

เกมสล็อตแตกง่าย

I truly appreciate this blog.Much thanks again. Really Cool.

https://slotxogame88.net/

is nuubu legit

I loved your post.Really thank you! Great.

https://ipsnews.net/business/2022/01/08/nuubu-detox-foot-patches-review-does-it-really-work-or-scam/

Best SEO Company

Thanks so much for the blog post.Thanks Again. Will read on…

https://www.weydinger.com/berlin-seo/

6.5 prc ammo sale

Enjoyed every bit of your article.Really looking forward to read more. Really Cool.

https://globalammodepot.com/

trust wallet private keys export

It’s difficult to find well-informed people about this subject,but you seem like you know what you’re talking about!Thanks

https://twrecoverytools.godaddysites.com/

Clitoral Vibrator

Looking forward to reading more. Great article.Really thank you!

https://www.youtube.com/watch?v=qf4QpzpA63g

Best Dildo

Thanks-a-mundo for the blog. Fantastic.

https://www.youtube.com/watch?v=GZuOsILjUAE

Adam And Eve Masturbator

wow, awesome article post. Much obliged.

https://www.youtube.com/watch?v=b0MpEBIbSfY

Adam and Eve Butt Plug

Looking forward to reading more. Great blog post.Really looking forward to read more. Much obliged.

https://www.youtube.com/watch?v=Ff1SuF2kDyQ

Rechargeable Bullet

I cannot thank you enough for the blog. Want more.

https://www.youtube.com/watch?v=4NcpfgBnqxk

Adam and Eve Strap On Toys

Looking forward to reading more. Great article.Thanks Again. Fantastic.

https://www.youtube.com/watch?v=9mtzBJ9D1gw

see

I am so happy to read this. This is the kind of info that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this greatest doc.

https://cse.google.co.th/url?sa=i&url=http3A2F2Fwww.afiaghana.com2F

Prostate Vibe

I appreciate you sharing this post. Really Cool.

https://www.youtube.com/watch?v=M9LOdf3W_M4

Wand Vibrator

I cannot thank you enough for the post.Thanks Again. Fantastic.

https://www.youtube.com/watch?v=BW6iLQojUWE

nickiern

nickiern 6368f9b739 https://wakelet.com/wake/m4B_xwGI0uslW-drvx3hk

top fake id

Appreciate you sharing, great article.Much thanks again. Great.

https://www.idpapa.com/

for more details

Greetings! Very helpful advice within this post! It’s the little changes which will make the greatest changes. Many thanks for sharing!

https://reddit-directory.com/Documenter_498661.html

kerb stone price in pakistan

Thanks again for the article post.Really thank you! Awesome.

https://www.novelconcrete.com/

xay dung hong phat

Absolutely composed written content, Reallyenjoyed looking at.My blog post :: Brilliance Keto Pills

https://lawyershirt7.bravejournal.net/post/2022/01/13/Best-Guidelines-for-Selecting-a-Top-quality-Luxury-Flat

Luz Rivera

Really enjoyed this article post.Thanks Again. Will read on…

http://docscp.over-blog.com

fabgers

fabgers 5d27fc3d97 https://wakelet.com/wake/dsVmIU-ggBgyQcTz2AUBo

self assessment tax return accountant

You have made some decent points there. I looked on the

https://self-assessment-tax-return.weebly.com/blog/all-about-taxes

robally

robally c2bcea2ebb https://wakelet.com/wake/ZN1ztSX5DQ5F__1xs9GUx

keto strong xp reviews

I truly appreciate this blog.Really looking forward to read more. Want more.

https://ipsnews.net/business/2022/01/13/keto-strong-xp-reviews-does-it-really-work-or-scam-pills/

vehjes

vehjes c2bcea2ebb https://wakelet.com/wake/K1ItuSrqDF8wZEQdz_ZXT

benenth

benenth c2bcea2ebb https://wakelet.com/wake/LGZWSfF8OXSRJpMawf0Df

yesihen

yesihen c2bcea2ebb https://wakelet.com/wake/WtJCwEzT2pEIXer-BcVFf

rayrand

rayrand c2bcea2ebb https://wakelet.com/wake/LBXAyjbN8VX796p9XmTVk

n scale model

I truly appreciate this blog post.Thanks Again. Will read on…

https://www.smallngaugelayouts.com/

Public-Private Partnerships

Appreciate you sharing, great blog post. Keep writing.

https://webchimarketing.link/maikmoberg43

Real Estate Developer

I really enjoy the post. Great.

https://myblogu.com/profile/cacyvacb98racll

try this

Appreciate you sharing, great article post.Really looking forward to read more. Want more.

https://www.exoltech.ps/wall/blogs/user/hosaiin

does shark motion work

I cannot thank you enough for the blog post.Really thank you! Fantastic.

https://topgadgethut.com/shark-motion-uk-reviews-does-it-really-work-or-scam-pills/

yevama

yevama f91c64177c https://fuckmate.de/upload/files/2021/10/K9rU1RoAgB6c4CHuKETz_11_f90b689c10381c2f4c1c844e05a10201_file.pdf

natcass

natcass f91c64177c https://7gogo.jp/BMMYVCV7AbDc

elladark

elladark f91c64177c http://elstopragve.blogg.se/2021/november/kalam-shah-hussain-pdf-freel.html

hotshot keto reviews

I value the blog article.Much thanks again. Great.

https://ipsnews.net/business/2022/01/14/hotshot-keto-reviews-does-it-really-work-or-scam/

nelsrey

nelsrey f91c64177c https://trello.com/c/IEPAY27E/12-sid-meiers-civilization-vi-proper-reloaded-hack-tool

belhawl

belhawl f91c64177c https://workplace.vidcloud.io/social/read-blog/1132

savjam

savjam f91c64177c https://unulunupci.wixsite.com/riddrobeno/post/hd-online-player-banjo-movie-full-hd-720p

ginenils

ginenils f91c64177c https://cdn.thingiverse.com/assets/99/4c/1d/15/28/bibytya308.html

is keto strong xp scam

Thanks so much for the blog article.Really thank you! Awesome.

https://ipsnews.net/business/2022/01/13/keto-strong-xp-reviews-does-it-really-work-or-scam-pills/

citiylan

citiylan f91c64177c https://creasdestresapphyd.wixsite.com/quireuferndis/post/brush-up-your-english-by-st-imam-pdf-free-download

catpeat

catpeat f91c64177c https://laf4e.net/upload/files/2021/11/aZXMbvadCYcrVE3laH34_27_65fe3b11513ca886e65d6b9b1b67de48_file.pdf

jalezona

jalezona f91c64177c https://wakelet.com/wake/wkbCioV2AU-eeA2MBR5zS

wynnwago

wynnwago f91c64177c https://fdocuments.in/document/zip-baba-black-sheep-mp3-activation-full-pc-crack.html

pazche

pazche f91c64177c https://wakelet.com/wake/rzRc1LsRS-asS6tcxQi4k

helahera

helahera f91c64177c https://cirvizuni.mystrikingly.com/blog/720-endgame-season-1-complete-dubbed-full-watch-online-utorrent

Singapore Cheap Incorporation

Very informative blog article.Really looking forward to read more. Really Cool.

https://www.stylemotivation.com/cheap-incorporation-with-3e-accounting/

halell

halell f91c64177c https://trello.com/c/i8Br4Orn/22-dazzle-moviestar-software-verified-free-download

impilavr

impilavr f91c64177c https://www.drupal.org/files/issues/2021-11-26/pearspr.pdf

kaldays

kaldays f91c64177c https://wakelet.com/wake/C8DiMK7SxnpMCnMlry2ZD

gregcel

gregcel f91c64177c https://trulasoutam.weebly.com/uploads/1/3/9/1/139142346/hana-yori-dango-final-sub-indo.pdf

greehed

greehed f91c64177c https://wakelet.com/wake/yKhUhNYnjByAwjZfCWcL4

jaywebs

jaywebs f91c64177c https://document.onl/data-analytics/download-luma-fusion-v2-v1281-unk-64bit-os133-ok13-user-hidden-bfi-ipa.html

hambet

hambet f91c64177c https://wakelet.com/wake/sgE5Dmixtl4sdG2mJpUAI

vanber

vanber f91c64177c https://wakelet.com/wake/hmLSY4p1byYCe0YW2HTX3

louraba

louraba f91c64177c https://dayspirmanira.wixsite.com/conmotymor/post/dual-office-2010-720-kickass-bluray-2k-watch-online-bluray

betfreb

betfreb f91c64177c https://letzbiletvergdervi.wixsite.com/siedetilsa/post/sony-acid-music-studio-10-0-key-cracked-full-download-pro

neilcera

neilcera f91c64177c https://7gogo.jp/ELV7ywAAt9bg

clodej

clodej f91c64177c https://wakelet.com/wake/l1jwfzHYHUKMK66x_MUir

carebar

carebar f91c64177c https://uploads.strikinglycdn.com/files/635edf8c-b5e8-4810-8fc4-7333f83ba5a9/Deuces-Wild-Online-Free.pdf

Home Solar in Atlanta

Say, you got a nice article.Really thank you! Want more.

http://korgorus.pl/index.php?title=User:Blueravenhomesolar

wander

wander f91c64177c https://www.pixnet.net/pcard/50413601ce7ca4a35c/article/415041b0-529b-11ec-a34a-29398cea4a11

overnight dog boarding boulder

I value the blog post.Really thank you! Really Great.

https://www.facebook.com/LovettsPetCare

gladber

gladber f91c64177c https://untieloling.weebly.com/download-centopeia-humana-1-dubladogolkes.html

toillea

toillea f91c64177c https://pdfslide.us/art-photos/ebook-free-download-fifty-shades-of-grey-1637938549.html

shaste

shaste f91c64177c https://trello.com/c/DL0mqlR0/13-nepobedivo-srce-1-epizoda-free-download

Awesome boulder dog day care

Thanks again for the blog.Much thanks again. Will read on…

https://www.pinterest.com/bouldersbestdogwalker

umayiso

umayiso f91c64177c https://cdn.thingiverse.com/assets/d5/77/74/b7/60/nch-wavepad-keygen-free-15.html

innrexa

innrexa f91c64177c https://docs.google.com/viewerng/viewer?url=forum.weeboo.id/upload/files/2021/11/sCHHHoUik819EbgzgMd7_29_d20ac894730f579bbe8bdde837d869e9_file.pdf

Superslot 888

Appreciate you sharing, great blog post.Really thank you!

https://superslot888.net/

destai

destai f91c64177c https://wakelet.com/wake/uzoL72zyPm-_vzTCWonYO

delvimm

delvimm f91c64177c https://gladforbackmarti.wixsite.com/ceisisbackme/post/wiiwii-sports-resortpalscrubbed-wbfs-hd-bluray-film-avi

hartan

hartan f91c64177c https://document.onl/data-analytics/texturepacker-440-mac-os-x.html

nanlety

nanlety f91c64177c https://trello.com/c/2KZK7tUk/25-kaptaan-movie-download-720p-hd-zymexyle

allonas

allonas f91c64177c https://trello.com/c/7bYWgzW5/13-full-edition-ghazwa-e-hind-download-pdf-rar-ebook

rebherm

rebherm f91c64177c https://www.pixnet.net/pcard/650276019c9f4776c8/article/6f5efcd0-5021-11ec-9554-93a5fa530f0b

สล็อต888

wow, awesome blog.Much thanks again.

https://superslot888.net/

iseaus

iseaus f91c64177c https://wakelet.com/wake/XiZetcyzHF2nUdN1zzRt8

cercarr

cercarr f91c64177c https://sinegadatop.wixsite.com/wisbemurip/post/build-sierra-generations-family-tree-full-version-x32-serial-torrent-zip-windows

rajnfryd

rajnfryd f91c64177c https://trello.com/c/91yH5BUs/19-david-weber-safehold-s-book-download-rar-epub-full-version

zighara

zighara f91c64177c https://wakelet.com/wake/UmyQRzIHTh4x-Q4MeCd7d

regichan

regichan f91c64177c https://www.drupal.org/files/issues/2021-11-26/sophifernl.pdf

devhard

devhard f91c64177c https://cdn.thingiverse.com/assets/6f/db/4a/1f/6d/the-1857-Tatya-Tope-in-hindi-pdf-free-download.pdf

weslcal

weslcal f91c64177c https://media.muckrack.com/portfolio/items/14826986/2011-Partituras-Inti-Illimanil.pdf

voysai

voysai f91c64177c https://terrioprecabddesar.wixsite.com/rismacalvo/post/english-create-your-own-naru-blu-ray-movie-1080

gaytchay

gaytchay f91c64177c https://wakelet.com/wake/Te41SGXb6HQrfvuMReJq8

demtal

demtal f91c64177c https://wakelet.com/wake/U7NyZ0IHMfDblSrxqeqF_

zyligwyn

zyligwyn f91c64177c https://cdn.thingiverse.com/assets/25/4c/47/af/a7/pinnacle_studio_16_ultimate_full_version_crack_activator_torrent.html

davihola

davihola f91c64177c https://www.realteqs.com/teqsplus/read-blog/2191

Top notch boulder doggie daycare

I loved your article post.Much thanks again. Awesome.

https://www.pinterest.com/bouldersbestdogwalker/lovetts-pet-care-boulder/

patbing

patbing f91c64177c https://stoic-archimedes-dd4c8b.netlify.app/GAME-OF-THRONESpdf

sadima

sadima f91c64177c https://insensuna.weebly.com/the-worst-week-america-has-had-in-a-really-long-time.html

vittwal

vittwal f91c64177c https://websconhabsgea.weebly.com/gemma-massey-porn-pics-belinda-adresses-mes.html

albenass

albenass f91c64177c https://kit.co/weischoczeata/flame2012-iso-pro-full-torrent-x32

garard

garard f91c64177c https://pdfslide.tips/marketing/refx-nexus-234-crack-mega.html

마사지

Thanks again for the article.Really thank you! Really Cool.

https://matown.kr/

건마

Thanks a lot for the article post.Much thanks again. Keep writing.

https://drive.google.com/file/d/1Iz0h4XN3undLuQOMGBzYJYHzf3dusSil/view?usp=sharing

ermaulbr

ermaulbr dd23f8915e https://wakelet.com/wake/IbrkHur0QsMaEs1-MnHUU

Upper East Side

Major thankies for the article post.Thanks Again. Fantastic.

https://www.youtube-nocookie.com/embed/FoAergLj48w?rel=0

chelili

chelili dd23f8915e https://wakelet.com/wake/uRD8drRScrnUli6O-RJZg

cua thep chong chay

I must thank you for the efforts you’ve put in writing this blog. I’m hoping to check out the same high-grade content from you in the future as well. In truth, your creative writing abilities has encouraged me to get my very own blog now ?

https://notes.io/PwrN

glowic reviews

Enjoyed every bit of your blog. Fantastic.

https://ipsnews.net/business/2022/01/17/glowic-by-5th-glow-reviews-does-it-really-work-or-scam-serum/

does keto burn max really work

Muchos Gracias for your blog article.Really thank you! Much obliged.

https://ipsnews.net/business/2022/01/17/keto-burn-max-uk-reviews-does-it-really-work-or-scam-pills/

does ezdigest really work

Thanks for the blog.Really thank you! Fantastic.

https://ipsnews.net/business/2022/01/17/ez-digest-reviews-does-it-really-work-or-scam-pills/

newtcor

newtcor 79a0ff67a5 https://coub.com/stories/2641656-mean-girls-2-mp4-install

ellmyt

ellmyt 79a0ff67a5 https://coub.com/stories/2676329-exclusive-mandy-flores-slave-airport

ranjala

ranjala 79a0ff67a5 https://coub.com/stories/2701379-authorization-letter-to-claim-prc-24-epub-morpan

ambrola

ambrola ba0249fdb3 https://wakelet.com/wake/6Yl2M3JT6JOMWNZQw3izt

slot

Wow, great blog post.Really looking forward to read more. Will read on…

http://139.180.217.206/demoslot

look at here now

Very good blog.Really thank you! Awesome.

https://drive.google.com/file/d/13jzZiHw7nW6VFyfAe5SO_eEwNoWuHk6N/view?usp=sharing

marisco gallego a domicilio

Very informative blog.Really looking forward to read more. Really Cool.

https://0rz.tw/create?url=https3A2F2Fmariscogalego.com2F

curar un piercing

Thanks for your marvelous posting! I definitely enjoyed reading it, you’re a great author.I willalways bookmark your blog and definitely will come back later on. I want to encourage you to continue yourgreat posts, have a nice afternoon!

http://www.cplusplus.com/user/NoemiPrince/

does folicrex really work

Muchos Gracias for your blog post.Thanks Again.

https://ipsnews.net/business/2022/01/20/folicrex-reviews-does-it-really-work-safe-to-use/

888สล็อต

Thanks for the article post.Really looking forward to read more. Keep writing.

https://slotxogame88.net/สล็อตเว็บตรง

suction cup jelly dildo

I really enjoy the post.Really looking forward to read more. Really Cool.

https://www.youtube.com/watch?v=8jzSVARNQp8

these details

hi!,I really like your writing so much! percentage we keep in touch extra about your article on AOL? I need an expert on this house to unravel my problem. Maybe that is you! Having a look ahead to peer you.

https://t.co/HimehZEpt3

american dildo

Great blog post.Thanks Again. Much obliged.

https://www.youtube.com/watch?v=HBSbwKipF88

Clicking Here

Hi there, just became alert to your blog through Google, and found that it is truly informative. I am going to watch out for brussels. I will appreciate if you continue this in future. Many people will be benefited from your writing. Cheers!

https://t.co/97LrwuO3rG?apm=1

rabbit vibrator

Im grateful for the blog.Much thanks again. Keep writing.

https://www.youtube.com/watch?v=Ufkk_oJolpQ

why not check here

When some one searches for his essential thing, so he/she needs to be available that in detail,thus that thing is maintained over here.

https://t.co/hRgFW5yZVD

Snapchat Of Models

A big thank you for your post.Really thank you! Really Cool.

http://gg.gg/xl92d

safrfer

safrfer 7383628160 https://coub.com/stories/3031488-auto-tune-efx-2-ilok-crack-14-full

what is the best nft art to invest in

Im grateful for the blog article.Much thanks again. Want more.

https://opensea.io/collection/michael-rabone

anthwelb

anthwelb 7383628160 https://www.cloudschool.org/activities/ahFzfmNsb3Vkc2Nob29sLWFwcHI5CxIEVXNlchiAgMCA0fzDCAwLEgZDb3Vyc2UYgICAv6Gu_QsMCxIIQWN0aXZpdHkYgIDAoNikxwsMogEQNTcyODg4NTg4Mjc0ODkyOA

amazon product

It as just letting clientele are aware that we are nevertheless open up for home business.

https://www.freewebmarks.com/story/amazon-com-vont-led-headlamp-batteries-included-2-pack-ipx5-waterproof-with-red-light-7-modes-head-lamp-for-running-camping-hiking-fishing-jogging-headlight-headlamps-for-adults-amp-kids-tools-amp-home-improvement

sex dolls

I really enjoy the article post. Want more.

http://www.339jump.com/

visit ukraine insurance

Incredible loads of excellent material. cbd gummies

http://trungtamytethanhtri.vn/Default.aspx?tabid=120&ch=249140

opapheo

opapheo 7383628160 https://trello.com/c/H3JztdTi/62-steamapi-registercallresult-1-wavepeg

สล็อตแตกง่าย

Great, thanks for sharing this blog article.Thanks Again. Really Cool.

https://slotxogame88.net/

dargama

dargama fe98829e30 https://wakelet.com/wake/0vlPJAi3QIac20B4Jl1Kg

hayglen

hayglen fe98829e30 https://coub.com/stories/2941678-igoprimowindowsce60download-exclusive

click here

the best ed pills – do over the counter erectile dysfunction pills work microgynon ed fe family planning pills

https://diigo.com/0n8hnc

natcra

natcra fe98829e30 https://www.cloudschool.org/activities/ahFzfmNsb3Vkc2Nob29sLWFwcHI5CxIEVXNlchiAgMDA08DhCAwLEgZDb3Vyc2UYgIDAoOGAngkMCxIIQWN0aXZpdHkYgIDA0PyL-woMogEQNTcyODg4NTg4Mjc0ODkyOA

RV Paint And Body Shops Near Me

Thanks-a-mundo for the blog. Cool.

https://edmullen.net/gbook/go.php?url=https://ocrvcenter.com

devulu

devulu fe98829e30 https://www.cloudschool.org/activities/ahFzfmNsb3Vkc2Nob29sLWFwcHI5CxIEVXNlchiAgIC_g7XnCwwLEgZDb3Vyc2UYgICA_5PBzwoMCxIIQWN0aXZpdHkYgIDAwOmpvgoMogEQNTcyODg4NTg4Mjc0ODkyOA

gardgarl

gardgarl fe98829e30 https://wakelet.com/wake/2WKsnqLnq8V0ZOQbhfpn9

boostsmmpanel.com

Thanks for finally talking about > Meme Monday –

https://pbase.com/topics/taxirail96/a_few_good_factors_to_use_an

pest control for woodworm

Thanks again for the article.Much thanks again. Really Cool.

https://apex-pest-control.blogspot.com/2021/12/pest-control-sheffield.html

quarmarr

quarmarr fe98829e30 https://coub.com/stories/2951780-descargar-gratis-contaplus-elite-2012-release-6-upd

bot xong nha

chloroquine death hydroxychloroquine reviews

https://public.sitejot.com/runhealth45.html

ottell

ottell fe98829e30 https://www.cloudschool.org/activities/ahFzfmNsb3Vkc2Nob29sLWFwcHI5CxIEVXNlchiAgMDAx5uYCgwLEgZDb3Vyc2UYgICA_9OpgwsMCxIIQWN0aXZpdHkYgIDA4LWHngoMogEQNTcyODg4NTg4Mjc0ODkyOA

alloy wheel repair

This is one awesome article post.Thanks Again. Want more.

https://mgyb.co/s/zaLrM

chexia

chexia fe98829e30 https://trello.com/c/peZE8TA5/38-clplaystationeyeplatformsdk1640028setupfree-kayhap

Vay tin chap theo luong techcombank

top erection pills: erectile dysfunction medications – best pill for edbest ed pills

https://coolpot.stream/story.php?title=vay-theo-luong-chuyen-khoan-techcombank#discuss

lynyola

lynyola fe98829e30 https://wakelet.com/wake/1lejukU4kgapToluNn7az

du an thanh long bay

slots online play slots free online slots

https://hoodleg6.tumblr.com/post/674359768070176769/deluxe-apartments-living-what-might-you-imagine

dorcaol

dorcaol fe98829e30 https://coub.com/stories/2949535-adobe-cs3-keygen-free-download-of-x-force-work

Enquiry

You hold an exceptional aptitude. Your composing proficiencies are truly effective. Kudos for promoting content via the internet and educating your viewers.

https://t.co/tplY9E87Eh?amp=1

lorifay

lorifay d868ddde6e https://coub.com/stories/3058632-jet-audio-7-0-5-3040-plus-vx-full-version-skin-updated

commercial pest control

I appreciate you sharing this blog post.Really looking forward to read more. Will read on…

https://s3.eu-west-2.amazonaws.com/apexpestcontrol/index.html

jacybar

jacybar d868ddde6e https://coub.com/stories/2945537-banksoalpknsmkkelasxi-work

find more here

Great post. I was checking continuously this blog and I’m impressed!Extremely useful info specially the last part ? I care forsuch information a lot. I was looking for this particular information fora very long time. Thank you and good luck.

https://thoughts.com/the-ideal-processor-chips-to-select-from/

เช่าชุดไทยใกล้ฉัน

Thanks for the article. Really Great.

https://trello.com/dreamretee

tanbin

tanbin d868ddde6e https://coub.com/stories/3107835-top-crack-active-win-7-vn-zoom-register

Read The Article

Hi there friends, pleasant piece of writing and good urging commented at this place, I am actuallyenjoying by these.

https://t.co/2jJ4CM7ioI?amp=1

markwar

markwar d868ddde6e https://coub.com/stories/3011059-quantum-qhm7468-2v-usb-gamepad-drive

pedrica

pedrica d868ddde6e https://coub.com/stories/3100405-nomad-factory-magma-pro-virtual-studio-rack-v1-0-1-vst-x86-x64-w-free-download-upd

halo sapphire engagement ring for wedding

Thanks a lot for the article.Really looking forward to read more. Cool.

https://www.pinterest.com/weddingblog20/halo-sapphire-engagement-ring-for-wedding/

ellwar

ellwar d868ddde6e https://coub.com/stories/2964858-descargar-fullbuild1-package-sims-3-gratis-jalkee

leirmon

leirmon d868ddde6e https://coub.com/stories/3096279-download-razor1911-crack-for-gta-4-eflclkjh-vinigeor

Self assessment tax rteurn

Aw, this was an exceptionally good post. Finding the time and actual effort to generate a good articleÖ but what can I sayÖ I hesitate a whole lot and never seem to get nearly anything done.

https://selfassessmenttaxreturnaccountant.wordpress.com/2022/01/21/why-should-you-consider-hiring-the-services-of-self-assessment-tax-return-accountant/

sanbcha

sanbcha d868ddde6e https://coub.com/stories/3091597-vmware-thinapp-enterprise-5-1-1-2722044-serial-64-bit-vicvest

dilljess

dilljess d868ddde6e https://coub.com/stories/3124795-link-pc-game-ita-opera-fatal

vannfinn

vannfinn d868ddde6e https://coub.com/stories/3044483-full-inpa-506-and-ediabas-730

movie

Really appreciate you sharing this article post.Much thanks again. Want more.

https://lock-a-folder.en.softonic.com/

benjwal

benjwal d868ddde6e https://coub.com/stories/3129741-virtuagirl-credit-hack-v1-0

dalcho

dalcho d868ddde6e https://coub.com/stories/3107504-driver-san-francisco-online-multiplayer-crack-38-ferrjess

yonabar

yonabar d868ddde6e https://coub.com/stories/2998076-bike-cad-pro-torrent-12

rosawaf

rosawaf d868ddde6e https://coub.com/stories/2995719-football-manager-2019-v26-10-1-cracked-multi19-setup-free-__top__

ivanite

ivanite d868ddde6e https://coub.com/stories/3104046-mac-os-x-lion-10-7-5-dmg-torrentl

marbens

marbens d868ddde6e https://coub.com/stories/2975167-complete-human-anatomy-primal-3d-interactive-series-9cds-repost-new-version

lavyanah

lavyanah d868ddde6e https://coub.com/stories/3041695-qubicle-constructor-master-edition-crack-new-31

zebcor

zebcor b7f02f1a74 https://branodcatidibi.wixsite.com/paulibiwill/post/scenepd5serialrar

radngary

radngary b7f02f1a74 https://martyidkeuper.wixsite.com/soipavebun/post/registration-mehndi-rachan-lagi-hatha-me-64bit-download-windows-rar-crack-full

rosewyn

rosewyn b7f02f1a74 https://dadaruca1995.wixsite.com/saddflexmalgest/post/r-s-bechler-user-latest-patch-windows-iso-full-utorrent-activation

Dong ho co odo

mectizan stromectol what is ivermectin for dogs

https://dchuskies.football/members/pianopiano59/activity/448257/

jansfre

jansfre c0c125f966 https://grigoriykostin894.wixsite.com/paiveluri/post/pc-scott-walker-any-day-64-software-download-activation

verokal

verokal fb158acf10 https://unicacsire.wixsite.com/biolaparbio/post/ywishywereusjessicag03oodm-epub

darknet links

If you like to play games with than a thousands and certainly e

http://www.bcsnerie.com/members/farmclub74/activity/1281475/

schakan

schakan fb158acf10 https://idellemoote554da50.wixsite.com/quitorccafin/post/jung-girl-in-the-tram-maybe-10-11yo-sequence-01-still001-imgsrc-ru

Over Here

Hello! Would you mind if I share your blog with my facebook group?There’s a lot of people that I think would really enjoy your content.Please let me know. Cheers

https://t.co/vBEZPMbNlZ?amp=1

denhylm

denhylm f4bc01c98b https://coub.com/stories/3249949-full-gemcom-whittle-4-3-with-crack-hit-better

morymalo

morymalo f4bc01c98b https://coub.com/stories/3302254-atashinchi-episodes-in-hindi-download-randkarr

ximemerc

ximemerc f4bc01c98b https://coub.com/stories/3225006-crack-fabfilter-saturn-1-0-1-vst-vst3-rtas-x86-updated

vienlat

vienlat f4bc01c98b https://coub.com/stories/3341587-gunsnrosesgreatesthitsfreedownload-better

waleif