Last week we paved the foundation for what you need to start thinking about and doing to retire early.

This week, we show you how to accelerate your retirement goals through the power of income-producing passive investments.

The Numbers.

To get to your 30x expenses goal, there are some simple tweaks that you can make now to accelerate reaching your retirement goals quicker. As a general rule, you should start by saving 4% of your gross income for investment.

To reach financial independence quicker, I highly recommend increasing your annual contribution amount incrementally.

Let’s start with an example:

Example

Assumptions:

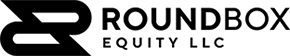

- Annual Salary: $120,000

- Annual Salary increase: 6%

- Current Age: 25

- Years until Retirement: 35

- Current Savings/Investment Rate: 4%

- Annual Rate of Return: 10%

If all you did was invest 4% of your annual gross income every year in a cash-flowing passive investment paying 10% annually, you can expect to have $2,550,235.

Here’s where it gets interesting:

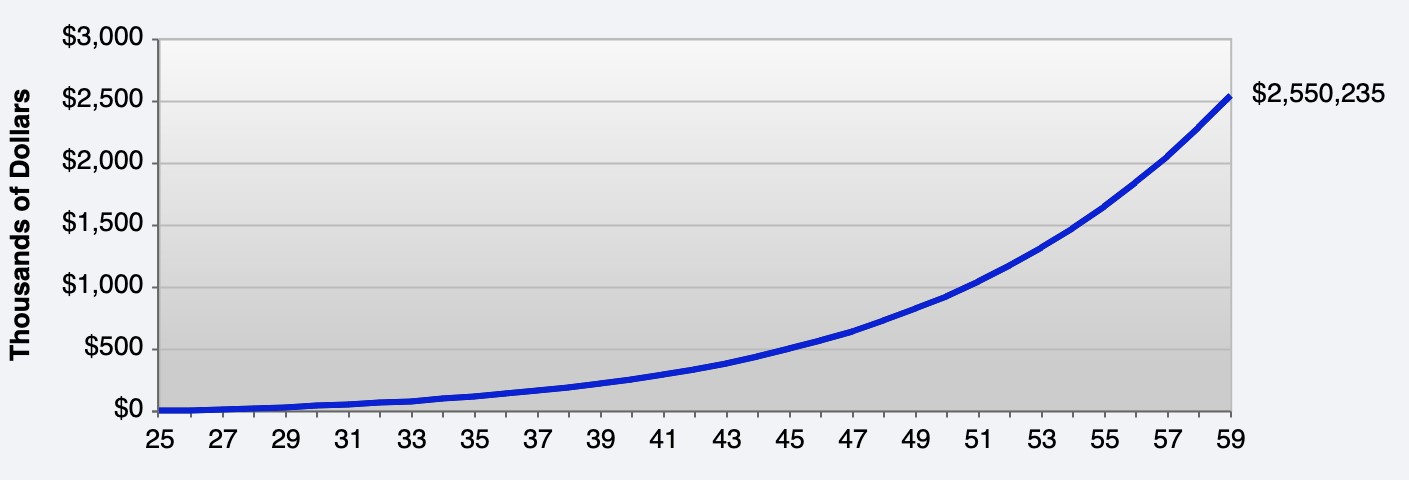

What if instead of sticking with your 4% savings/investment rule every year, you accelerated your contributions by say just 0.1%.

So, in year 1, you invest 4% of your gross income, but in year 2, you’re investing 4.1%, and so on.

Here’s what accelerating your contributions by just 0.1% each year will do for your retirement:

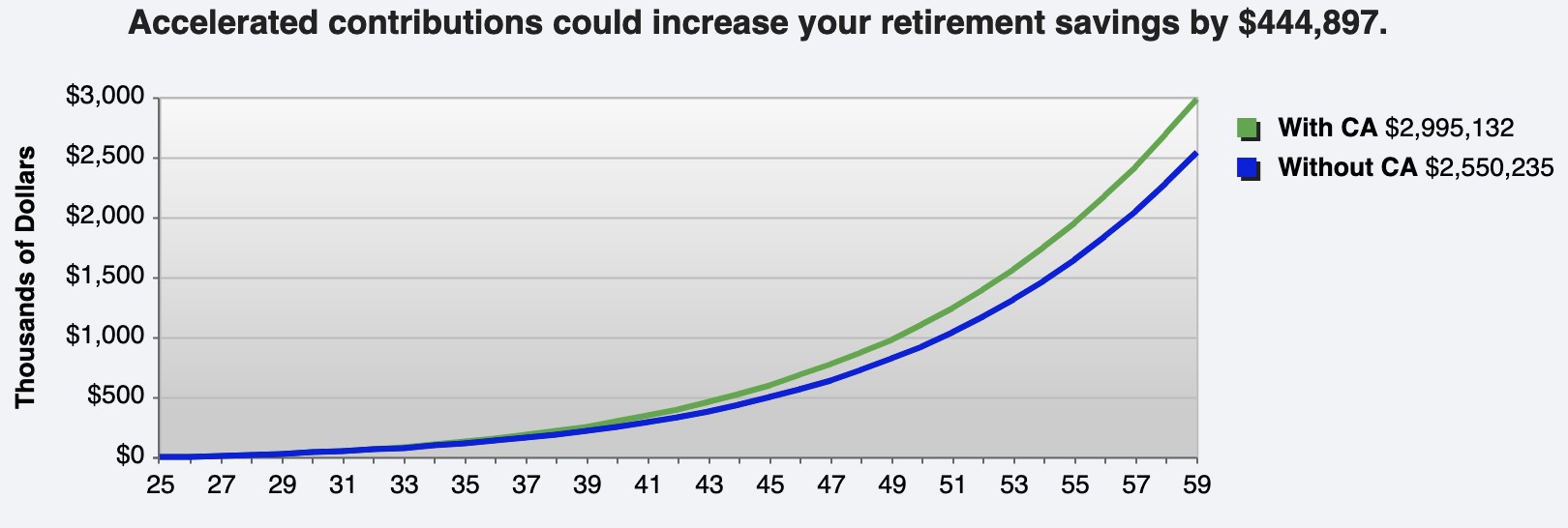

What if you accelerate your contributions by just 0.5% each year?

By accelerating your annual contributions by just .5% annually, you’ll have $1,253,644 more in savings at retirement age and you’ll be able to reach your milestone of $3 million a full 3 years sooner.

What if you accelerated your contributions by just 1% each year with a cap of 10%?

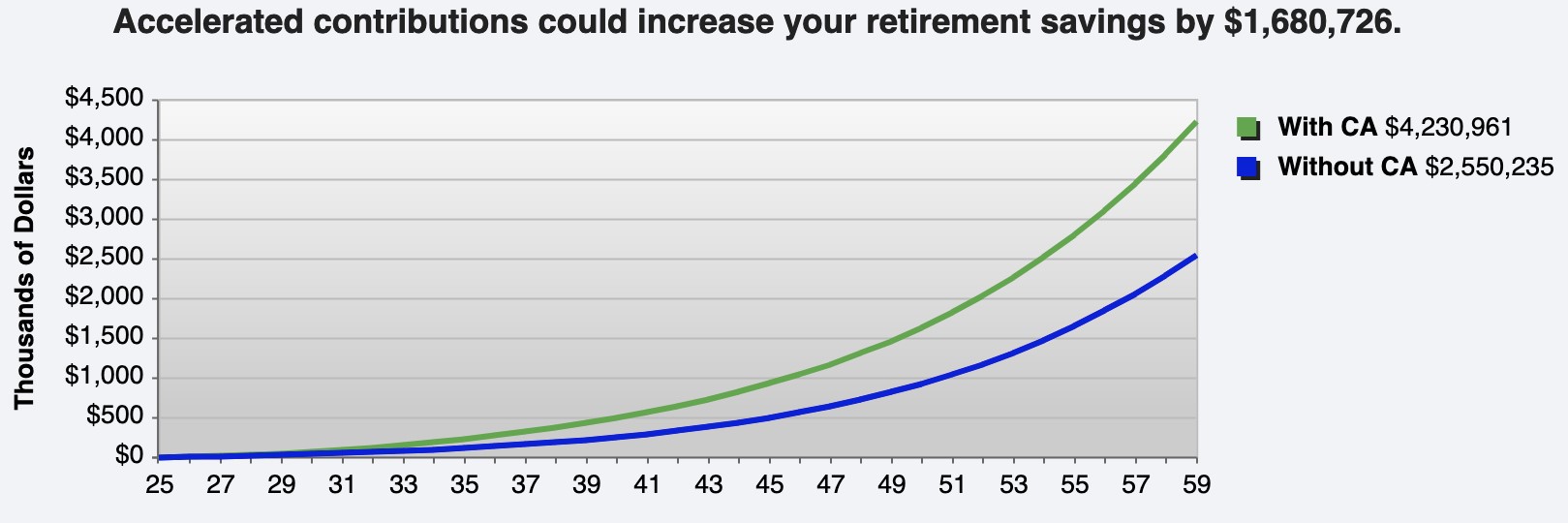

By accelerating your annual contributions by just 1% annually (capped at 10%), you’ll have $1,680,726 more in savings at retirement age and you’ll be able to reach your milestone of $3 million a full 4.5 years sooner!

I just showed you how a person making $120,000 a year can end up with $4,230,961 in retirement savings by the age of 60 if they started at the age of 25.

All it takes is investing in the right cash-flowing passive investments, starting by saving/investing 4% in the first year and increasing that amount by 1% each year.