Did you know that there are three types of income?

Look at your last year’s tax return. Where was the majority of your income reported? W-2? 1099? K-1?

Why do I ask? Let me explain the three types of income.

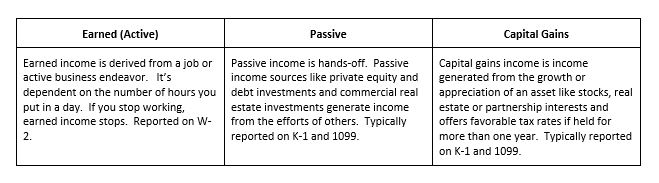

EARNED INCOME.

Earned (or active) income is income derived from the sweat of your brows. Growing up, we think this is the only way to get ahead. We go to school, work hard and become doctors, lawyers, accountants, and engineers, in hopes of climbing up the ladder of income and success, but there are several problems with earned income as a focus for building wealth:

- There’s a ceiling to how much you can make. There are only so many hours in the day.

- What if you get hurt and can’t work anymore?

- One day earned income will stop.

- You’ll always be trading time for money.

- Earned income is taxed at ordinary individual rates.

The problem with earned income is that it’s hard to multiply. You can’t be working two jobs at the same 8-6 shift. You can only be generating one stream of income during that time. You can work another job after your day shift, but nobody can work 24-7.

Another drawback of earned income is that earned income is taxed at ordinary rates, which are higher than capital gains rates. Compare the highest individual ordinary tax rate of 37% vs. 20% for the highest capital gains rate.

To achieve financial independence, you will need to break away from earned income.

PASSIVE INCOME.

Unless you generate passive income, you will always need to work to stay afloat. Passive income sources like hands-off commercial real estate investments, public and private equity and debt investments, and business partnership interests, are examples of passive income sources.

Passive income works for you while you sleep and – unlike a job – is capable of being duplicated. Multiple sources of passive income can be generating multiple streams of income at once. The rents from a multifamily investment and profit distributions from a private equity interest aren’t mutually exclusive. You can be earning both at the same time.

With passive income, not only can you be generating multiple streams of income, but you’ll be able to keep more of it as well.

Income derived from passive sources held for more than a year will be taxed at capital gains rates instead of higher ordinary rates.

CAPITAL GAINS.

Capital gains income or portfolio income is income generated from the sale of an investment asset. Capital gains can be earned from the sale of a real asset or business interest. In the public markets, it can be derived from the sale of stock.

Sometimes capital gains go hand in hand with passive income. An equity interest in a partnership or ownership in a real asset can cash flow as well as generate capital gains income from appreciation over time.

Why You Need All Three?

You need to start somewhere, and most people start their road to financial independence by earning active income through their jobs or running businesses. Some people work overtime or move up the corporate ladder to have more money to spend.

However, those who have achieved financial independence always had the goal of building wealth not accumulating toys. Working overtime and climbing the corporate ladder were merely means to an end – that being to accumulate more disposable income to invest in passive income sources.

When your passive income exceeds your expenses, you’ll achieve financial independence – independence from having to put in hours at a job or business. You start with earned income, but you need to transition to passive income and capital gains income to generate true wealth.

With passive and capital gains income, you can achieve your goals even faster with favorable tax treatment as you’re able to keep more of what you make – leaving more for reinvestment.

The ideal investment generates passive income while building capital gains income in the background. Cash flowing real assets and income-producing business interests that appreciate over time are examples of assets offering these dual benefits. This combination accelerates your wealth goals through the power of compounding.

The pandemic of 2020 brought urgency to many – who saw job losses or reductions – a need for alternative sources of income to compensate for lost income in a downturn.

Many turned to the stock market to roll the dice on their stimulus checks, but wise investors turned to established passive income sources shielded from downturns that reliably appreciate over time.

When earned income stops, make sure you have passive income to take over.