Like many individual investors who have come before you, you have been drawn to commercial real estate (CRE) investing for its many benefits and as an alternative to Wall Street. After all, CRE investments provide cash flow, appreciation, and tax benefits public equities don’t offer.

Having decided to take the plunge in the CRE investing pool, you are now at a crossroads as to whether you should invest actively or passively. There are pros and cons of each investing strategy that the investor should seriously consider before choosing an appropriate path.

With active investing, the investor is directly responsible for every phase of the investment timeline including acquisition, property management, and disposition, and all related activities in between.

Although various functions may be outsourced and performed by a third party, the active investor is ultimately responsible for the timely execution of all business functions and activities.

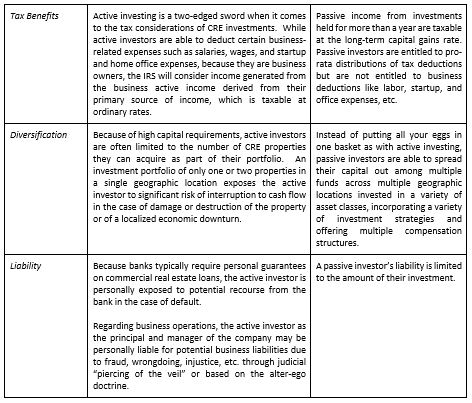

The following chart outlines the pros and cons of active vs. passive investing in light of the various considerations investors should take into account when making a CRE investment:

The decision to invest in CRE is an easy one. The decision to do it actively vs. passively is not so clear cut. Ultimately, it comes down to how much time and effort you’re willing to commit in connection with your investment.

In making such a determination, it’s important to understand what’s required of the active investor vs. passive investor at every stage of the CRE investment timeline.

Active investors like to stay in control and are willing to dedicate the time and personal capital required in connection with their investments.

Investors opting to go the passive route are willing to surrender control and forego retaining 100% of the profits as the business owner in exchange for a diversified portfolio of passive cash flow generating multiple streams of income.