There’s a lot of talk in politics, the news, and social media about redistributing wealth. However, advocates of this movement defend it as “just making things right.”

The narrative – typically coming from the mouths of millionaire politicians – is that the rich have built their fortunes on the backs of the poor. As long as people believe that, things will never change.

Take money from the rich and give it to the poor, and I promise you that money will make it back into the hands of the rich. Why? Because many of the rich are self-made.

Many started with nothing. They just figured out how to turn something very little into something very big. The rich don’t get richer because they steal from the poor; they get richer because they know how to make their money work for them. They attract money and do not repel it.

The reason why redistributed money will end up back in the hands of the rich is because the poor will give it to them.

They will spend the money on products, services, and commodities from companies owned by the rich who understand supply and demand and make money from it. Sounds simple right? Invest in demand.

The redistribution of income and wealth is the transfer of income and wealth (including physical property) from some individuals to others by means of a social mechanism such as taxation, charity, welfare, public services, land reform, monetary policies, confiscation, divorce or tort law. The term typically refers to redistribution on an economy-wide basis rather than between selected individuals.

Based on Wikipedia’s definition, the United States has been redistributing wealth for decades in the form of welfare. Yet, if you take a tour across the inner cities across America, you’d be hard-pressed to find any changes this redistribution has affected in these communities.

Transforming the poor into the rich will require something besides redistribution; it will require education – teaching the poor to think like the rich and stop thinking the rich are the root of their problems. Many of the rich who were once poor have all talked about how entitlement kept their peers back, but by taking the initiative and controlling their destinies, they could escape poverty.

Here’s how the poor, the middle class, and the rich differ:

- The poor spend all their money, the middle class spends most of their money and invests some of it.

- The wealthy spend some of their money and invest most of it and what they invest in is different from what the middle class invests in.

- Nothing changes at retirement. The poor will still be poor, the middle class will still just be getting by, and the rich will be doing whatever they want.

The middle class invests in what everyone else is investing in stocks and bonds. It’s all they’ve ever known, and it’s all anybody talks about, so why rock the boat? That’s why they will always be middle class; they’re never willing to break away from the middle of the pack.

On the other hand, the rich know that they have to go against the grain to get ahead. If they do what everyone else is doing, they’ll just be like everyone else.

So what do the rich invest in?

Let’s look at some of the riches of the rich and get a clue.

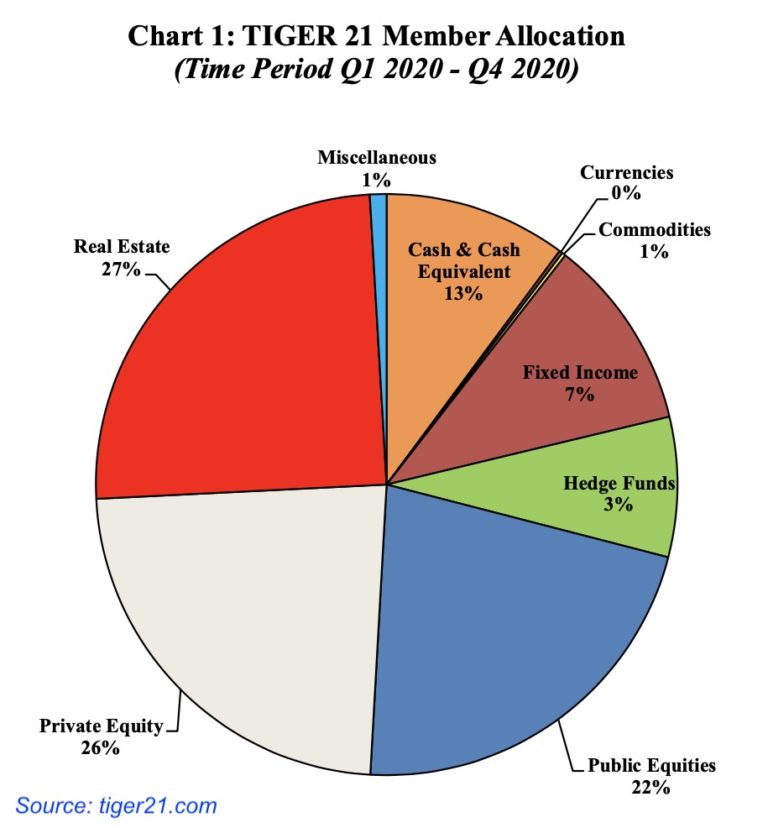

For those unfamiliar with Tiger 21, it’s a social investing club. It’s where the rich commensurate to share investing insights and ideas. $50 million in investable assets are required to join, so these investors know what they’re doing.

Of course, asset allocations vary across members, but they all gravitate towards two primary assets:

- Real Estate.

- Private Equity (ownership in private companies).

Why real estate and private equity? The rich favor illiquid tangible assets that Wall Street can’t tamper with, and the crowds can’t ruin. The ability to buy and sell instantly on the stock market makes every portfolio vulnerable to the madness of the crowds influenced by the slightest rumor, buzz, and incompetent talking head.

The rich prefer to take their hands out of the control of the crowds. That’s why they prefer real estate and private equity in the private markets.

Besides the insulation from stock market volatility, the real reason the rich like real estate and private equity is for the returns. Many members of Tiger 21 gained their fortunes from owning businesses, and most expect and achieve a 25% return on their portfolios – similar to the returns they got from their businesses.

If we want more people to achieve the status of the wealthy, don’t redistribute assets; redistribute knowledge.

For example, take what the rich know about investing and give it to the poor. That will go much further than just handing money to the poor that we know will end up back in the hands of the rich anyway.