Like other types of private investments, a passive investment in the residential assisted living (RAL) space can be high risk and highly rewarding.

So what differentiates the successful private deals and the ones that go south?

The Right Investment Partner!

The right investment partner in the RAL space can mean the difference between losing all your money and receiving a substantial return on your investment from income, appreciation, or both.

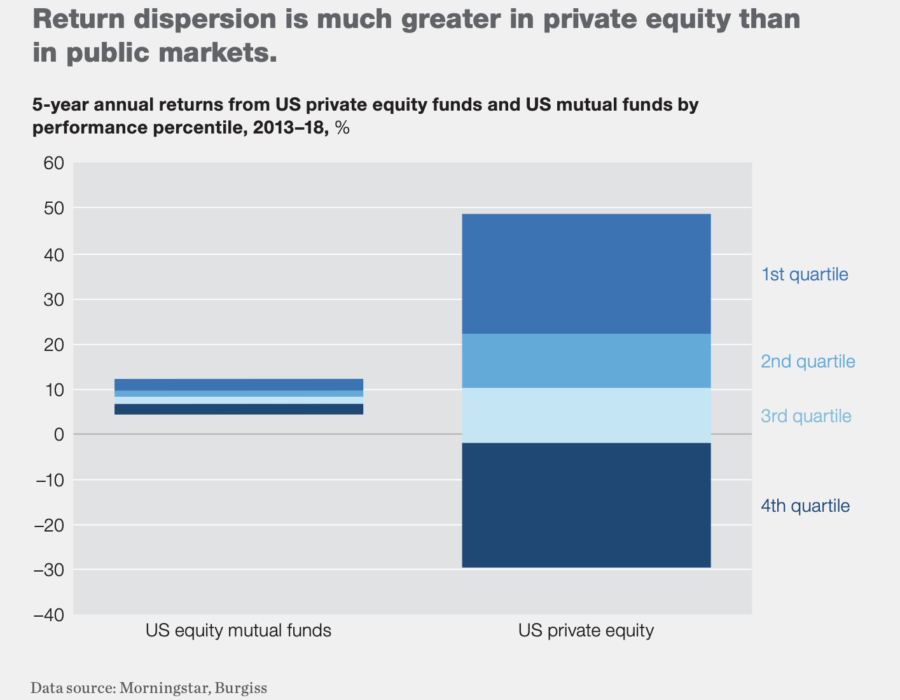

Savvy investors turn to passive real estate investments for their above-market returns. Although private investment funds pose potentially higher risks overall than the typical public mutual fund, they also offer the potential for significantly higher returns.

See the chart below:

A private equity investment – the technical term for an equity investment in a private company or fund – can result in significant losses, as shown in the chart above, but also offers the potential for significantly higher returns. The primary differentiator between the funds at the top and the bottom is management experience, track record, and knowledge.

Choosing the right RAL partner mitigates a real estate private equity investment risk – often at lower risk than public options.

The key to choosing the right RAL fund that delivers above-market returns at reduced risk is choosing the right partners – the right sponsors with the knowledge, experience, expertise, and infrastructure to devise a business plan and execute it.

Here are some things to look for when evaluating potential RAL investment partners:

Experience in the Specific Asset Class.

Success in other real estate asset classes does not necessarily translate to success in the seniors housing class and the RAL segment. To maximize your odds of success, make sure the prospective investment partner has experience in the RAL segment.

Expert Prospectors.

Qualified sponsors are experts and finding and evaluating deals. They have the infrastructure, process, technology, and network in place for finding and evaluating deals. Anyone can find properties on Loopnet but not just any sponsor can find off-market “deals” – undervalued properties that offer the type of value-add or development opportunities that will generate the type of returns and ROI that investors covet.

The right sponsors have built up their prospecting processes and channels from their years of experience and track record. They’ve also dedicated significant time and effort to building and maintaining their deal channels through their local and virtual network of contacts and connections.

Experience with Operations.

Some RAL sponsors have all the right talking points, but many don’t have the experience necessary for successfully navigating the operations waters. Make sure your potential investment partner has experience running a RAL asset.

In addition, if the sponsor is touting a particular RAL environment such as small resident count homes (6-8), make sure they have experience with this particular RAL model. Not all models operate similarly.

Qualified sponsors will have established infrastructure, personnel, and processes to carry out the company’s investment and business objectives and follow through on the various stages of the investment timeline:

- Development.

- Pre-Operations.

- Operations.

- Dispositions.

- Exit.

- Post-Exit.

It would be best if you had a sponsor with experience, not one that’s going to wing it as they go – all with your money.

Track Record of Success in the RAL Segment.

A sponsor’s track record is crucial to the success of the current opportunity. Experience is not enough. Positive experience – including a track record of profitability – is crucial to the success of the opportunity before you.

Financial Sophistication.

Qualified sponsors are experts at analyzing and modeling multiple aspects of the financial side of the RAL investment. They are underwriting experts, modeling assumptions and making projections based on those assumptions. They don’t over-promise and are conservative with their modeling – taking into account all relevant inputs and variables to make qualified projections relating to the investment.

They will have answers to the following questions:

- What’s the total acquisition cost?

- Total costs with cap-ex?

- Will it be leveraged? If so, what are the interest expenses?

- What’s the cap rate at acquisition?

- What’s the projected cap rate at the time of disposition?

- What’s the projected first-year cash-on-cash return?

- The average annual return?

- The IRR?

Clear Objectives and Exit Plan.

Qualified sponsors know what they want to achieve and how to get there. Whether to provide investors and themselves with cash flow, appreciation, asset preservation, tax benefits, or a combination of one or more of those objectives – the experts have well thought out and clear and concise plans for executing those objectives.

Transparency.

Qualified sponsors have nothing to hide and will be open with their communications – including providing a process (i.e., online investor portal or through periodic communications) for delivering updates to investors.

The key to not losing your shirt when investing in a RAL private fund is the potential investment partner. Choosing the right partner can result in significant financial rewards. Choosing the wrong one can mean losing all your money.

When evaluating potential investment partners, track record and experience are key, but other factors like the ones described above are also important.

Doing the due diligence on the front end will spare your heartburn on the back. Good luck.