The recent push by Congress and the SEC to open up private investments to a bigger pool of qualified investors has been unprecedented.

Besides the JOBS Act that loosened the advertising rules on certain exempt private offerings and crowdsourcing, the SEC has taken other steps to make private exempt offerings available to more investors.

For example, on December 6, the SEC expanded the definition of an Accredited Investor to include certain professionals and individuals holding certain certifications who may not meet the traditional net worth and income requirements. Until this year, the definition of Accredited Investor had remained largely unchanged since first adopted in 1982.

The SEC’s efforts to open private markets up has worked. According to a recent SEC report, in 2019, for the first time, more capital was raised through Regulation D (the most widely used SEC private exemption) offerings than from registered offerings (i.e., IPOs).

Why the push for opening up private markets? In the words of SEC Director of the Division of Investment Management, Dalia Blass, it’s because:

“Private investments have the potential to provide stronger returns and diversification for investors, but come with both performance and liquidity risks.”

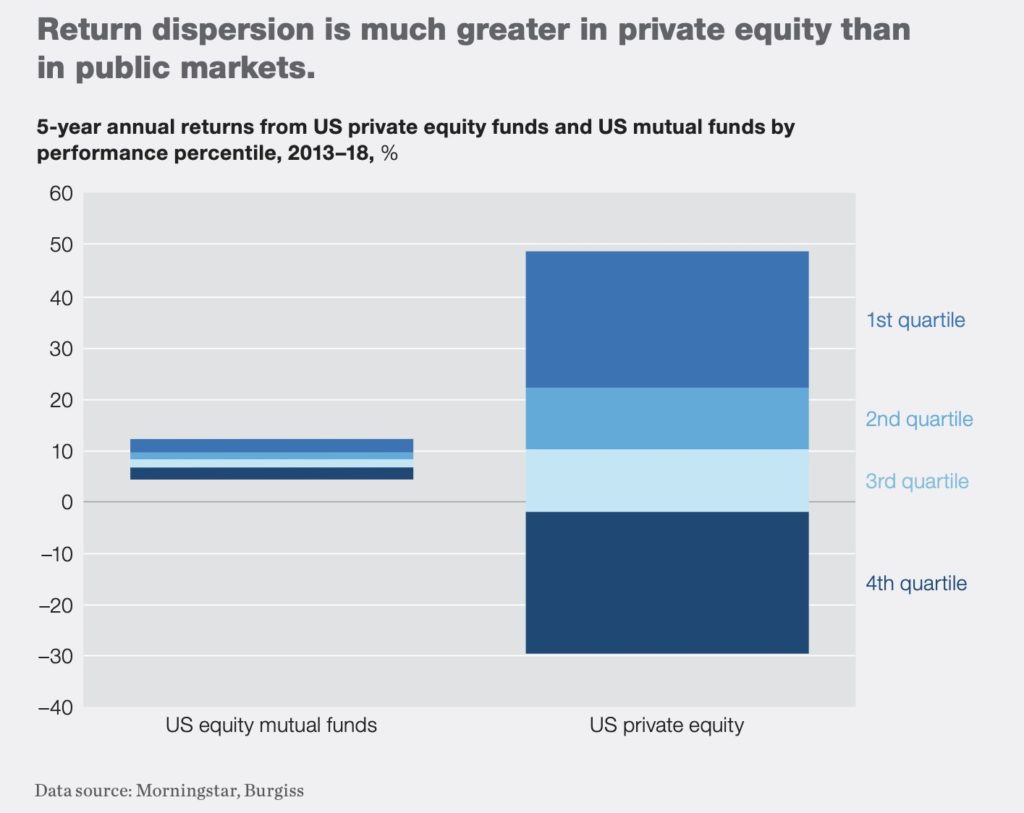

Private investments have long appealed to elite investors for above-market returns. They are not without risks, however, as the following chart demonstrates.

According to the chart, private investments have the potential to reward investors with returns far above those offered through public offerings like mutual funds. However, private investments could also potentially result in greater losses.

The X-Factor:

So how do elite investors consistently overcome risks to generate returns far exceeding the public markets?

The X-Factor is management. Research has shown that savvy investors that can pick top managers can outperform the market by a wide margin.

SCREENING AND PICKING THE RIGHT MANAGERS IS THE #1 FACTOR IN DETERMINING YOUR PRIVATE INVESTING SUCCESS.

Top 12 Questions to Ask Before Investing in a Private Real Estate Fund or Syndication:

Asking the right questions about a potential private investment opportunity is important towards aligning the funds’ investment objectives with those of your own.

These questions should help you separate the seasoned professionals from rookies and can mean the difference between achieving above-market risk-adjusted returns and losing your shirt. Seasoned managers are highly methodical and analytical and have data and numbers to back up all their projections.

These questions should help you bring into focus management’s objectives as well as the business plan for carrying out those objectives:

ONE – What is your track record?

Have you invested in this type of asset class and subsegment before? Do you have financial statements to show past performance?

Be leery of management with a lack of a track record in the particular asset class in which they’re attempting to raise capital to invest in.

A ten-year track record of flipping homes won’t necessarily translate to success in the commercial real estate space.

TWO – What is your educational and professional background?

This will give you insight into a manager’s motivation and what factors drove them towards commercial real estate investing.

What is it about commercial real estate that appealed to them? Passive income? Appreciation?

THREE – What asset classes, property classes, and investment strategies do you prefer?

Which asset classes do you focus on – Multifamily, Office, Industrial, Retail, Hospitality, or Special Purpose?

What property types do you prefer – A, B, C, or D?

What investment strategies do you pursue most often – Core, Core-Plus, Value-Add, Opportunistic?

The answers to these questions will give you an idea about a manager’s risk tolerance and a general timeline for when to expect initial returns on your investment.

Management that pursues Class A, Core, Core-Plus properties is looking for a plug and play opportunities with solid tenants, low vacancies, and that cash flow instantly.

Managers who favor Class C and D Properties using value-add or opportunistic strategies like to get their hands dirty but these opportunities – although in the long run may provide the highest returns – may not immediately bear fruit. It may take one to two years before investors start seeing distributions once these types of properties are stabilized.

FOUR – What are your competitive advantages?

This question complements question 3. If management favors value-add opportunities, what exactly do they do to add value? How do they plan to increase NOI? Increase income? Reduce expenses?

Seasoned management will have comprehensive, clear, and concise answers to these questions.

FIVE – What type of infrastructure, processes, technology, and support staff do you leverage to carry out your business plan?

Seasoned and experienced professionals should have detailed answers to these questions.

Follow-up questions can include: How they find undervalued properties? What professional, personal, and community connections do they leverage to find buying opportunities? What professional functions like property management, marketing, legal, accounting, do they have in-house and what do they outsource?

SIX – What is your investment objective, strategy, projections, and market data for this project?

By now, you should have a general idea of the M.O. of this particular manager or management team, but now it’s time to get down to the details of this particular project:

Why this property and this location? Do you plan on using other sources of capital? Bank loans? What’s your investment strategy? What is your plan for adding value if any? What are the numbers? IRR? Cash-on-Cash Returns?

Seasoned management should have all of this dialed in.

SEVEN – How is management compensated?

The management compensation structure should give you insight into a particular manager’s investment philosophy.

Does management put the investors first or have they put themselves in a position to get paid whether the fund makes money or not? Multiple, high dollar management fees are a red flag. Management should receive reasonable management fees with the bulk of their compensation coming from profit splits.

Investors typically receive a share of first-dollar profits in the form of preferred returns and split profits from operations and dispositions with management.

EIGHT – What are the holding period and exit strategy?

This should be exact, but don’t be taken aback by qualifiers.

Example: “You should expect to commit your capital for a minimum of five years. We plan to refinance or sell the property after five full years of operations to return investment capital.”

NINE – Have you raised money for pooled investments before?

Have you been involved in prior private placements? If so, what is your track record of success? Can you provide referrals of current or prior investors?

Experience raising capital through private offerings and acquiring and operating properties through a private fund are relevant but not deal killers. Everyone needs to start somewhere. Relevant investing experience is more crucial in determining management competence.

In Silicon Valley, many successful tech workers and entrepreneurs who have never launched a private placement typically have no problems raising and mobilizing capital because of their relevant experience.

TEN – Do you have any unique tax strategies that you can discuss?

Specific tax strategies such as plans to commission a cost-segregation study to leverage bonus depreciation are relevant for getting a big picture of management’s tax reduction and income augmenting strategies

ELEVEN – How do you communicate with investors?

How do you communicate with investors and what is the substance and frequency of information and data provided? Do you have an investor portal where investors can see company communication and download financial reports? Are these provided monthly, quarterly, semi-annually, annually?

TWELVE – What other projects do you currently have in the works?

This should give you an idea of where management is focused on the future. Are they going to stick with what they’ve known in markets they’re familiar with or are they looking to expand to bigger assets in new markets?

By now, you should have a pretty good idea of whether this management team has the goods for being successful now and in the future.