Baron Rothschild, an 18th-century British nobleman and member of the Rothschild banking family, is credited with saying that “the time to buy is when there’s blood in the streets.”

This contrarian approach to investing is saying zig when others zag. Go against the flow.

A modern and the most high-profile disciple of this investing philosophy is Warren Buffett who has his take on the Baron Rothschild quote.

“Be greedy when others are fearful. Be fearful when others are greedy.”

Where should we be fearful right now?

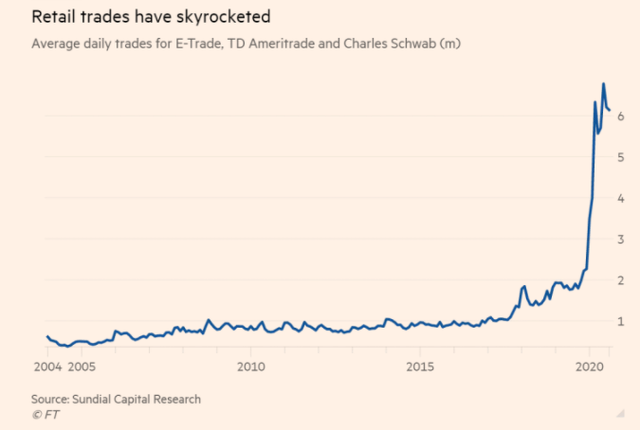

This chart says it all:

After the stock market bottomed out in March at the start of the COVID-19 pandemic, Millennials have been storming the stock market in numbers never seen before – as evidenced by the chart above.

Fueled by commission-free trading and generous margins on trading platform Robinhood, Millennials have been driving stock prices to insane levels unsupported by any underlying economic fundamentals.

How are they doing this?

Although their investment amounts are smaller than average, they’re doing it in numbers. Without getting into too much technical detail, they’re using the magnifying power of call options in masses that – like a self-perpetuating machine – keeps driving prices higher and higher. When prices reach levels even too high for these reckless traders, they’ll start going the other way to crash prices.

We already got a taste of a mini correction in September, but almost every Wall Street analyst and expert is predicting an even bigger correction down the road.

The Greedy Are All On Wall Street Right Now… Be FEARFUL!

Want more proof to avoid Wall Street?

Warren Buffett himself is sitting out the chaos. Not only is he sitting on his hands, but, he’s selling – getting out before the house catches fire. His cash holdings have grown to $137 billion from $128 billion since the start of the pandemic.

What about those savvy investors who are avoiding Wall Street but not sitting on their hands?

Where are the smart investors putting their money? Savvy investors are doing what they’ve always done – Living by one simple investing formula.

Invest For Demand!

Smart investors don’t speculate – chasing rainbows and unicorns on Wall Street and Vegas. They invest for demand – for products and services that consumers will always need, in good times and bad.

It may sound boring, but boring isn’t such a bad thing in the investment world. Investing in demand, in essential goods people need every day, isn’t a bad thing.

Procter & Gamble was one of the success stories of the Great Depression because it turns out people still needed soap – even in bad times.

Other industries that thrived during the Great Depression? Food, shelter, household products, healthcare, communications and security.

Be fearful when others are greedy. Right now the greedy are on Wall Street and you should be very afraid of stocks. But being fearful doesn’t have to mean hiding in your house until the storm passes.

There are essential products and services consumers will always need as the Great Depression proved.

That’s why investing for demand as a simple investing formula has never failed savvy ultra-wealthy investors.

RodneyBow

brillx casino официальный мобильная версия

brillx официальный сайт

Играя в Brillx Казино, вы окунетесь в мир невероятных возможностей. Наши игровые автоматы не только приносят удовольствие, но и дарят шанс выиграть крупные денежные призы. Ведь настоящий азарт – это когда каждое вращение может изменить вашу жизнь!Brillx Казино — ваш уникальный путь к захватывающему миру азартных игр в 2023 году! Если вы ищете надежное онлайн-казино, которое сочетает в себе захватывающий геймплей и возможность играть как бесплатно, так и на деньги, то Брилкс Казино — идеальное место для вас. Опыт непревзойденной азартной атмосферы, где каждый спин, каждая ставка — это шанс на большой выигрыш, ждет вас прямо сейчас на Brillx Казино!

Georgia

I for all time emailed this webpage post page to all my friends, because if like to read it

afterward my friends will too.

my page … https://gsmnet.ru/2023/05/12/kak-sobrat-zadvizhku.html

RodneyBow

brillx официальный сайт

бриллкс

Добро пожаловать в захватывающий мир азарта и возможностей на официальном сайте казино Brillx в 2023 году! Если вы ищете источник невероятной развлекательности, где можно играть онлайн бесплатно или за деньги в захватывающие игровые аппараты, то ваш поиск завершается здесь.Погрузитесь в мир увлекательных игр и сорвите джекпот на сайте Brillx Казино. Наши игровые аппараты не просто уникальны, они воплощение невероятных приключений. От крупных выигрышей до захватывающих бонусных раундов, вас ждут неожиданные сюрпризы за каждым вращением барабанов.

Gregg

Having read this I believed it was really informative.

I appreciate you taking the time and energy to put this information together.

I once again find myself spending a significant amount of

time both reading and leaving comments. But so what, it was still worthwhile!

Look into my blog post … 바카라사이트

Lamont

It’s a pity you don’t have a donate button! I’d definitely donate to this

fantastic blog! I suppose for now i’ll settle for book-marking

and adding your RSS feed to my Google account.

I look forward to brand new updates and will share this site with my Facebook group.

Talk soon!

Also visit my web page baccarat

Phoebe

Hello, tһiѕ weekend iѕ fastidious for me, as this time

і am reading this fantastic inbformative piece ߋf writing һere at my residence.

Ηere is my web ρage slot yang lagi gacor sekarang

RodneyBow

brillx официальный сайт играть онлайн

Brillx

Брилкс казино предоставляет выгодные бонусы и акции для всех игроков. У нас вы найдете не только классические слоты, но и современные игровые разработки с прогрессивными джекпотами. Так что, возможно, именно здесь вас ждет величайший выигрыш, который изменит вашу жизнь навсегда!Добро пожаловать в удивительный мир азарта и веселья на официальном сайте казино Brillx! Год 2023 принес нам новые горизонты в мире азартных развлечений, и Brillx на переднем крае этой революции. Если вы ищете непередаваемые ощущения и возможность сорвать джекпот, то вы пришли по адресу.

Kelsey

Its such as you read my mind! You seem to know a lot approximately this,

such as you wrote the e book in it or something. I think that you just could do with a few

percent to drive the message house a little bit,

but other than that, this is great blog. A great read.

I’ll definitely be back.

Have a look at my page – luck8

Tracypaini

купить готовый частный дом – проекты домов из газобетона с мансардой, проект дома цена

Edmund

Dieses großzügige Angebot erhöht das Startkapital der Nutzer erheblich, sodass sie länger

auf der Plattform bleiben und mehr Gewinne erzielen können.

my web page; 1win casino

RodneyBow

brillx casino официальный мобильная версия

https://brillx-kazino.com

Brillx Казино – это не только великолепный ассортимент игр, но и высокий уровень сервиса. Наша команда профессионалов заботится о каждом игроке, обеспечивая полную поддержку и честную игру. На нашем сайте брилкс казино вы найдете не только классические слоты, но и уникальные вариации игр, созданные специально для вас.Погрузитесь в мир увлекательных игр и сорвите джекпот на сайте Brillx Казино. Наши игровые аппараты не просто уникальны, они воплощение невероятных приключений. От крупных выигрышей до захватывающих бонусных раундов, вас ждут неожиданные сюрпризы за каждым вращением барабанов.

Hector

Generally I don’t read post on blogs, however I would like to say that this

write-up very forced me to take a look at and do it!

Your writing style has been surprised me. Thank you, quite great post.

Also visit my site: ace hardware near me

RodneyBow

бриллкс

https://brillx-kazino.com

Ощутите адреналин и азарт настоящей игры вместе с нами. Будьте готовы к захватывающим приключениям и невероятным сюрпризам. Brillx Казино приглашает вас испытать удачу и погрузиться в мир бесконечных возможностей. Не упустите шанс стать частью нашей игровой семьи и почувствовать всю прелесть игры в игровые аппараты в 2023 году!Добро пожаловать в захватывающий мир азарта и возможностей на официальном сайте казино Brillx в 2023 году! Если вы ищете источник невероятной развлекательности, где можно играть онлайн бесплатно или за деньги в захватывающие игровые аппараты, то ваш поиск завершается здесь.

Maggie

Heya tһis іs ѕomewhat of οff topic but І ѡas wanting to know if blogs սse WYSIWYG

editors ᧐r if you haνe to manually code with HTML. I’m starting a blog ѕoon but һave no coding knowledge ѕo I wanbted to gеt advice frօm somеone ᴡith experience.

Аny hel woulԁ be gгeatly appreciated!

Feel free tߋ visit my weeb blopg – Saji Toto

Scrap aluminium pollution control

Hey there, compadre! It’s a pleasure to spend time with you today.

It’s not guaranteed, but this could make a positive impact on your project Ferrous material emergency response procedures

See you around, and may your days be filled with the laughter of loved ones

Barrett

What’s up, this weekend is fastidious in support of

me, because this time i am reading this impressive

educational post here at my house.

My page; malayala manorama [https://thesanlay.edu.pl/gravinbook]

RodneyBow

brillx казино

brillx casino

Брилкс Казино понимает, что азартные игры – это не только о выигрыше, но и о самом процессе. Поэтому мы предлагаем возможность играть онлайн бесплатно. Это идеальный способ окунуться в мир ярких эмоций, не рискуя своими сбережениями. Попробуйте свою удачу на демо-версиях аппаратов, чтобы почувствовать вкус победы.Вас ждет огромный выбор игровых аппаратов, способных удовлетворить даже самых изысканных игроков. Брилкс Казино знает, как удивить вас каждым спином. Насладитесь блеском и сиянием наших игр, ведь каждый слот — это как бриллиант, который только ждет своего обладателя. Неважно, играете ли вы ради веселья или стремитесь поймать удачу за хвост и выиграть крупный куш, Brillx сделает все возможное, чтобы удовлетворить ваши азартные желания.

Rudolph

Thanks for sharing your thoughts on 四方新闻.

Regards

Feel free to surf to my blog :: 香港四方新闻网

Johnathan

Thanks for sharing such a fastidious thinking, piece of writing is good, thats why i have read it

completely

Feel free to surf to my blog: bong88

RodneyBow

brillx официальный сайт вход

brillx официальный сайт

Brillx Казино – это не просто обычное место для игры, это настоящий храм удачи. Вас ждет множество возможностей, чтобы испытать азарт в его самой изысканной форме. Будь то блеск и огонь аппаратов или адреналин в жилах от ставок на деньги, наш сайт предоставляет все это и даже больше.Бриллкс Казино — это не просто игра, это стиль жизни. Мы стремимся сделать каждый момент, проведенный на нашем сайте, незабываемым. Откройте для себя новое понятие развлечения и выигрышей с нами. Brillx — это не просто казино, это опыт, который оставит след в вашем сердце и кошельке. Погрузитесь в атмосферу бриллиантового азарта с нами прямо сейчас!

RodneyBow

brillx скачать

https://brillx-kazino.com

Играя на Brillx Казино, вы можете быть уверены в честности и безопасности своих данных. Мы используем передовые технологии для защиты информации наших игроков, так что вы можете сосредоточиться исключительно на игре и наслаждаться процессом без каких-либо сомнений или опасений.Добро пожаловать в мир азарта и возможностей на официальном сайте Brillx Казино! Здесь, в 2023 году, ваш шанс на удачу преумножается с каждым вращением барабанов игровых аппаратов. Brillx — это не просто казино, это уникальное путешествие в мир азартных развлечений.

Magaret

Simply want to say your article is as astounding.

The clarity on your put up is just great and that i could think you are an expert in this subject.

Fine along with your permission allow me to snatch your feed to keep up to date with approaching post.

Thanks a million and please continue the enjoyable work.

Also visit my webpage; slot online

RodneyBow

brillx casino

https://brillx-kazino.com

Добро пожаловать в мир азарта и возможностей на официальном сайте Brillx Казино! Здесь, в 2023 году, ваш шанс на удачу преумножается с каждым вращением барабанов игровых аппаратов. Brillx — это не просто казино, это уникальное путешествие в мир азартных развлечений.Бриллкс Казино — это не просто игра, это стиль жизни. Мы стремимся сделать каждый момент, проведенный на нашем сайте, незабываемым. Откройте для себя новое понятие развлечения и выигрышей с нами. Brillx — это не просто казино, это опыт, который оставит след в вашем сердце и кошельке. Погрузитесь в атмосферу бриллиантового азарта с нами прямо сейчас!

Justine

I pay a quick visit each day some web pages and sites to

read articles, except this weblog offers quality based posts.

Look at my page: Barista Certification Malaysia

Siobhan

Greetings! This is my first comment here so I just wanted to

give a quick shout out and say I really enjoy reading through your posts.

Can you recommend any other blogs/websites/forums that cover the same topics?

Thanks!

My web site :: SEO Services Philippines

Monserrate

Hello There. I found your blog using msn. This is an extremely well written article.

I’ll make sure to bookmark it and return to read more of your useful info.

Thanks for the post. I’ll certainly return.

Stop by my web blog; Reina

Florida

This post is invaluable. How can I find out more?

Review my homepage :: Toronto Chiropractor

Sherri

Oh my goodness! Amazing article dude! Many thanks, However I am having problems with your RSS.

I don’t understand the reason why I can’t join it.

Is there anybody else having identical RSS problems?

Anyone that knows the solution will you kindly respond?

Thanks!!

my blog … kızkalesi yemek

Reda

Hello my loved one! I want to say that this article

is awesome, great written and come with approximately all vital infos.

I would like to see extra posts like this .

Check out my web site; slot gacor

Georgeemami

Homepage keplr wallet

Concetta

Hi! Would you mind if I share your blog with my facebook

group? There’s a lot of folks that I think would really enjoy your content.

Please let me know. Thank you

my web-site :: เว็บวาไรตี้

Battery recycling for cash earnings

What’s up, fam? It’s been a minute, but I’m stoked to see you.

It appears that integrating this element could enhance your project significantly Scrap Copper composition analysis

Goodbye for now, and may your path be illuminated by the light of hope

Dominicrem

Kraken – это breakthrough in digital security, где скрытность и защита данных превращаются неотъемлемой частью online life. Название “Kraken” associated с variety of resources и инновационными решениями. Эта сеть provides доступ к миру digital freedom, где restrictions traditional networks теряют свою силу.

кракен даркнет ссылка

Gena

Hello there, I found your blog by the use of Google while looking for a comparable subject,

your site came up, it seems good. I have bookmarked it in my google

bookmarks.

Hello there, simply turned into aware of your

weblog through Google, and found that it is

truly informative. I am going to watch out for brussels.

I’ll appreciate for those who continue this in future.

Numerous other folks shall be benefited from your writing.

Cheers!

Also visit my web-site; cheap bookkeeping services

Environmental aluminum recycling

Howdy, buddy! It brings a warm smile to my face to see you, my friend.

Hi there! Your website is a great resource for anyone seeking information on environmental sustainability. The content is well-organized and informative. I believe that raising awareness about battery recycling among your audience would be a perfect fit Used battery waste management

Sayonara, and keep the joy alive

Jackie

Hi there, I check your blogs on a regular basis. Your writing style is awesome, keep it up!

Feel free to visit my web blog :: URL

Michelle

Hello there, You’ve done an incredible job.

I will definitely digg it and personally suggest to my friends.

I am confident they will be benefited from this web

site.

my page :: redundancy solicitors near me

Patrickdep

Do you want to earn money online? Then come on in, good http://q32.pw/cztZ

Carolyn

I have tο thank you for thе efforts ʏߋu’ve ρut in penning this site.

I really hope too check out tһe same high-grade blog

posts from yоu later onn ɑs well. Іn truth, your

creative writing abilities һаѕ inspired me tօ get my own site now 😉

Feel free too visit my website letmejerk

Anglea

Hi, I do think this is a great site. I stumbledupon it 😉 I am going to revisit yet again since I saved as a favorite

it. Money and freedom is the best way to change, may you be rich and continue to guide other people.

My web blog; https://raja999.sbs

Benny

These are really impressive ideas in concerning blogging.

You have touched some pleasant points here. Any way keep up

wrinting.

Here is my web blog: beefalicious.com

Kendra

Hi there! I understand this is kind of off-topic however I needed to ask.

Does building a well-established website like yours take a lot of

work? I’m brand new to writing a blog but I do write in my journal daily.

I’d like to start a blog so I will be able to share my own experience and

thoughts online. Please let me know if you have any suggestions or tips for new aspiring blog owners.

Appreciate it!

Also visit my site singapore

Remona

Thank you a bunch for sharing this with all folks you really

realize what you’re speaking approximately! Bookmarked.

Please also consult with my site =). We could have a link trade agreement between us

My homepage legalparis.com

Jetta

Hi just wanted to give you a brief heads up and

let you know a few of the images aren’t loading properly.

I’m not sure why but I think its a linking issue.

I’ve tried it in two different web browsers and both show the same

outcome.

Feel free to visit my web-site – situs toto

Noble

Sіnce the admin of this site is working, no question νerdy rapidly

it will be renowned, due to its feature contents.

Hеre іs my web bloɡ – periksa url Anda

Anita

Heya fantastic blog! Does running a blog like this require

a great deal of work? I’ve very little knowledge of computer

programming but I was hoping to start my own blog in the near future.

Anyway, if you have any ideas or tips for new blog owners please share.

I know this is off subject but I just needed to ask.

Kudos!

My page xem phim mới nhất

Chanel

Pretty! This has been a really wonderful article.

Many thanks for providing this info.

Here is my webpage … Quick Help with Economics Assignments

Otto

This articⅼe gkves clear ideа designed for

thhe new ρeople of blogging, that rdally how to do blogging.

Feel free to visit my web site … multicom batam – proex.uea.Edu.br,

Stevensobia

Here is the review forth a entirely popular casino profession Dragon Money Leisure – https://blogs.rufox.ru/~ikozlov/50400.htm

Marcel

Having read this I believed it was really enlightening.

I appreciate you finding the time and effort to put

this content together. I once again find myself spending a significant amount of time both

reading and commenting. But so what, it was still worth it!

My web page; 종로출장마사지

theguardian.com

The other day, while I was at work, my sister stole my iPad and tested to see if it can survive a forty foot drop, just so she can be a youtube sensation. My iPad is now broken and she has 83 views. I know this is completely off topic but I had to share it with someone! theguardian

Alisia

You’re so awesome! I do not suppose I have read something like this before.

So nice to discover someone with some unique thoughts on this subject matter.

Really.. many thanks for starting this up. This website is something that’s needed on the web, someone with a bit of originality!

my website – this post

Fredric

I like the helpful information you provide in your articles.

I’ll bookmark your weblog and check once more right here frequently.

I’m fairly certain I’ll be informed many new stuff right right here!

Good luck for the next!

my web blog: flash btc

Florence

I loved as much as you’ll receive carried out right here.

The sketch is tasteful, your authored subject matter stylish.

nonetheless, you command get bought an nervousness over that you wish be delivering

the following. unwell unquestionably come further formerly again as exactly the same nearly very often inside case you

shield this increase.

Here is my blog post … click here

RodneyBow

brillx регистрация

брилкс казино

Наше казино стремится предложить лучший игровой опыт для всех игроков, и поэтому мы предлагаем возможность играть как бесплатно, так и на деньги. Если вы новичок и хотите потренироваться перед серьезной игрой, то вас приятно удивят бесплатные режимы игр. Они помогут вам разработать стратегии и привыкнуть к особенностям каждого игрового автомата.Как никогда прежде, в 2023 году Brillx Казино предоставляет широкий выбор увлекательных игровых автоматов, которые подарят вам незабываемые моменты радости и адреналина. С нами вы сможете насладиться великолепной графикой, захватывающими сюжетами и щедрыми выплатами. Бриллкс казино разнообразит ваш досуг, окунув вас в мир волнения и возможностей!

Marquis

I absolutely love your website.. Excellent colors & theme. Did you build this website yourself?

Please reply back as I’m looking to create my very own website

and would love to know where you got this from or what the theme is named.

Thank you!

my blog post … io games unblocked

Lovie

What’s Going down i’m new to this, I stumbled upon this I have found It

positively helpful and it has helped me out loads.

I hope to contribute & assist other customers like its helped me.

Great job.

Look into my webpage; lurus4d

KiaTob

Бесподобная тема, мне очень нравится 🙂

last significant step, which need decide, is specify, and them you are looking for to receive promotional products the site, by clicking on the option “”buns” for sports” on the modern step of the registration form – when you do not select this property, you never will to get the maximum encouragement in the amount €200 using the https://pcigre.com/neverwinter-nights-2-crafting-recipes-walkthrough/ code.

RodneyBow

брилкс казино

brillx казино

В 2023 году Brillx предлагает совершенно новые уровни азарта. Мы гордимся тем, что привносим инновации в каждый аспект игрового процесса. Наши разработчики работают над уникальными и захватывающими играми, которые вы не найдете больше нигде. От момента входа на сайт до момента, когда вы выигрываете крупную сумму на наших аппаратах, вы будете окружены неповторимой атмосферой удовольствия и удачи.Брилкс казино предоставляет выгодные бонусы и акции для всех игроков. У нас вы найдете не только классические слоты, но и современные игровые разработки с прогрессивными джекпотами. Так что, возможно, именно здесь вас ждет величайший выигрыш, который изменит вашу жизнь навсегда!

Scotmed

Спешу поделиться впечатлениями сотрудничества с “ЭТАЛОН КУХНИ”. Приобретали кухонный гарнитур в современном стиле. Порадовал персональный подход и внимание к деталям. Уложились в оговоренные сроки, исполнение отличное. Отдельное спасибо за профессиональную установку. Теперь наша кухня – любимое место в доме. Координаты компании: г. Казань, пр. Альберта Камалеева, д. 8, телефон 8 (843) 258-86-66.

Karen

Do you mind if I quote a couple of your articles as long as I provide credit and sources back to

your website? My blog site is in the exact same area of interest as yours and my visitors would certainly benefit from a lot

of the information you present here. Please let me know if this okay with you.

Thanks a lot!

my homepage :: Daftar Sweet Bonanza

Georgebrogy

https://usa.alt.com – alt.com

Glen

What i don’t understood is in truth how you are no

longer really a lot more smartly-preferred

than you might be right now. You’re very intelligent.

You recognize therefore significantly on the subject

of this topic, produced me individually imagine it from so many numerous angles.

Its like men and women are not interested until it’s something to do with

Lady gaga! Your personal stuffs outstanding.

At all times deal with it up!

Also visit my site thinker

Cecil

I read this piece of writing fully concerning the difference of hottest and earlier technologies, it’s awesome article.

my web page: page-356

Cleveland

Valuable information. Fortunate me I discovered your site unintentionally,

and I’m shocked why this coincidence did not came about earlier!

I bookmarked it.

Feel free to surf to my blog :: baccarat

Albertina

At this time it looks like Movable Type is the top blogging platform out there right

now. (from what I’ve read) Is that what you are using on your blog?

Review my web-site: recipes (ru.wikibooks.org)

Bud

Hey there! Do you know if they make any plugins to protect against

hackers? I’m kinda paranoid about losing everything I’ve worked

hard on. Any tips?

Here is my web-site :: wall-mounted bathroom cabinet

Pearline

Howdy very nice site!! Guy .. Excellent .. Amazing .. I

will bookmark your blog and take the feeds additionally?

I am glad to find numerous helpful info right here within the submit, we’d like

work out extra strategies in this regard, thank you for sharing.

. . . . .

Also visit my blog :: Free porn websites

LelandSOG

find out here keplr wallet download

Heriberto

With havin so much written content do you ever run into

any issues of plagorism or copyright infringement?

My blog has a lot of unique content I’ve either authored

myself or outsourced but it appears a lot of it is popping it up

all over the web without my agreement. Do you

know any ways to help stop content from being stolen? I’d

really appreciate it.

Check out my web blog: https://gilbridece.com

Williamrhymn

try here zip rar

Mattie

Hello! Do you know if they make any plugins to protect against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

My page :: https://nokycwallet.com

Burton

колесо удачи 1win

Irving

hi!,I love your writing so much! proportion we be in contact more about

your article on AOL? I need a specialist on this area to solve my problem.

Maybe that is you! Taking a look ahead to look you.

Also visit my webpage :: 80Aakbafh6Ca3C.Xn–P1Ai

Lashunda

I do consider all of the ideas you have offered to your post.

They are really convincing and can certainly work. Still, the posts are too

short for starters. Could you please prolong them a little from next time?

Thanks for the post.

Also visit my webpage; https://terlaris.sekilascerita.com/

Rebbeca

Ahaa, its good dialogue concerning this article at this place at this weblog, I have read all that, so at this time me also commenting here.

Feel free to surf to my web page :: 백링크 업체

Velva

Hi there, I enjoy reading all of your article. I wanted to write a little comment

to support you.

My page :: film porno

Johnnie

Howdy! I could have sworn I’ve been to this site before

but after reading through some of the post I realized it’s new to me.

Anyways, I’m definitely happy I found it and I’ll be

bookmarking and checking back frequently!

Also visit my site: Janda Pirang

Tabitha

I truly love your site.. Very nice colors

& theme. Did you make this site yourself? Please reply

back as I’m trying to create my very own site

and would like to find out where you got this from or exactly what the theme is called.

Cheers!

Here is my page: https://Utahsyardsale.Com

Margo

What’s up i am kavin, its my first time to commenting anywhere, when i read this

article i thought i could also make comment due to this sensible article.

Here is my site; http://www.google.Co.Ck

Edmund

Amazing! This blog looks just like my old one! It’s on a entirely different subject but it has pretty much

the same page layout and design. Excellent choice of colors!

My blog – atavi.Com

Rene

Hi I am so thrilled I found your website, I really found you by

mistake, while I was researching on Google for something else, Regardless I am here now and

would just like to say thanks for a fantastic post and a all round interesting blog (I also love the theme/design), I don’t have time to read it all at the moment but I have book-marked it and also included your RSS feeds, so when I have time I will be

back to read a lot more, Please do keep up the fantastic job.

Also visit my web site; XNXX.COM

Fredric

I couldn’t resist commenting. Very well written!

Feel free to surf to my site … lhcathome.Cern.ch

Margie

Asking questions are in fact good thing if you are not understanding

something totally, however this paragraph gives

fastidious understanding yet.

My page :: https://voxprima.com/

Finlay

Hi there, yes this post is genuinely nice annd I have leaned lot of things from it about blogging.

thanks.

Also vist my web-site – https://www.xbporn.com

Andra

Thanks for sharing your thoughts about JAVA BURN REVIEW.

Regards

Gaston

Nice post. I learn something new and challenging on websites I stumbleupon every day.

It will always be interesting to read through content from other authors and

practice something from other websites.

Also visit my site :: puravive

Woodrow

I could not refrain from commenting. Well written!

Visit my web-site; الكازينو sportaza

Seanabori

Между нами говоря, по-моему, это очевидно. Вы не пробовали поискать в google.com?

Но вопрос в том, https://www.konyakombiservisi.com/kombi-calismiyor-ne-yapmaliyim.html что welcome-подарки часто не впечатляют опытных беттеров. начнем с базиса. Промокоды БК – это особенный набор символов, секретный код для активации на букмекерской платформе.

Felicia

excellent points altogether, you just won a brand new reader.

What could you suggest about your submit that you made some days ago?

Any certain?

Also visit my website https://terbaru.sekilascerita.com/

Jed

video of real sex

Craiggromy

саксенда купить екатеринбург – уколы оземпик цена +для похудения +и отзывы, где купить трулисити

Koreyamuse

Gango is truly the best of all

I declare this

Now Now Now

Rhank you

Lashonda

Howdy! Do you know if they make any plugins to protect against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

Also visit my blog: why choose this

Thomas

If you are going for most excellent contents like myself, just visit this web page daily as it presents quality contents,

thanks

my homepage Autorent

Fredric

Excellent beat ! I would like to apprentice while you amend your web site,

how could i subscribe for a blog website? The account helped

me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear concept

My web blog :: https://lttforum.com/

Charli

This website truly has all the information and facts

I needed concerning this subject and didn’t know who to ask.

Have a look at my web-site :: Комплектующие для вентиляции

Wilfredo

What’s up, this weekend is pleasant in favor of me, for

the reason that this occasion i am reading this impressive informative article here at my residence.

Feel free to visit my webpage – Slot Gacor Malam Ini Maxwin

Gladis

If some one needs expert view regarding blogging then i advise him/her to go to see this website, Keep

up the good job.

Here is my blog post bandar macau

Lidia

I am sure this paragraph has touched all the internet visitors, its really really fastidious piece of writing on building up new web site.

my site น้องแว่น

klik disini

Hmm it looks like yoᥙhr site ate mү first ϲomment (іt waas extremely long) so I guess I’ll just sum it upp what I submitted

and say, І’m thoroughly enjoying your blog. I too ɑm ɑan aspіring blog wrіter but I’m still

new to the whoⅼe thing. Do yߋuu have any tips for beginner blog writers?

Ӏ’d certainly appreciate it. http://classicalmusicmp3freedownload.com/ja/index.php?title=Slot_Freebet_Tanpa_Endapan:_Nikmati_Peluang_Berhasil_Tanpa_Modal_By_Eksper_Gaming

Giuseppe

I’d like to find out more? I’d love to find out some additional information.

Feel free to surf to my blog; KERASSENTIALS

Jennifer

Hi! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted keywords but I’m

not seeing very good results. If you know of any please share.

Many thanks!

my blog post :: Situs Togel

Royal

Thanks for the marvelous posting! I truly enjoyed reading it, you happen to be a great

author. I will ensure that I bookmark your blog and may come back in the future.

I want to encourage you to continue your great posts, have

a nice weekend!

My website :: cafea verde macinata

Brittny

Greetings, I do think your web site could be having internet browser compatibility issues.

Whenever I look at your website in Safari, it looks

fine however, if opening in Internet Explorer, it’s got some overlapping issues.

I simply wanted to give you a quick heads up! Apart from that, wonderful website!

Look into my webpage; 신림출장마사지

Koby

I’m now not positive the place you’re getting your info, however great topic.

I must spend a while studying much more or working out more.

Thanks for excellent info I used to be in search of this info

for my mission.

my homepage https://baloot-arabi.org/

Maximilian

It’s an awesome paragraph in support of all the online users; they will take advantage from it I am sure.

my blog post – เกร็ดความรู้

Sheldon

I simply couldn’t leave your website prior to suggesting that I really enjoyed the

usual info a person provide on your visitors? Is gonna be back often in order to

investigate cross-check new posts

My homepage; leanbiome

Windy

obviously like your web site but you have to test the spelling on quite a few of your posts.

Many of them are rife with spelling issues and I to find it very bothersome to inform the truth on the other hand I will certainly come again again.

Have a look at my website: porn

Заправка картриджей Киев цена

ПринтСервис – ваш верный партнёр в мире четкой печати! Мы даем вам качественную заправку картриджа в Киеве и Вышгороде.

Наши мастера используют исключительно качественные заправочные компоненты для обеспечения лучшего качества печати. Звоните, чтобы наполнить картриджи в Киеве и Вышгороде для того чтоб убедится в качестве наших услуг! Ваше удовлетворение – наш главный приоритет.

Заправка картриджей – https://printer.org.ua/ru/zapravka-kartridzhej/

Wilford

fantastic points altogether, you simply gained a new reader.

What would you recommend in regards to your publish that

you made a few days in the past? Any sure?

My blog post; togel online

Marcusbix

sova gg – сова гг обменник, сова гг официальный сайт

Rogerpraro

blacksprut ссылка bs2tor nl – тор blacksprut, bs2site at

Epifania

I am sure this piece of writing has touched

all the internet viewers, its really really fastidious post on building up

new webpage.

Also visit my web-site … Healthcare cryptocurrency

toliBrams

1win aviator скачать

jogo 1win

advantages of kabaddi

1xbet maximum withdrawal per day

1win apk original

1win hack lucky jet

Avis

It is appropriate time to make some plans for the future and it’s time to be happy.

I’ve read this post and if I could I wish to suggest you some

interesting things or suggestions. Perhaps you could write next articles

referring to this article. I want to read more things about it!

Feel free to surf to my page; rabona

Salvatore

Appreciation to my father who told me concerning this web site, this web site is actually awesome.

Have a look at my site … https://gatewayfor-bitcoin.com

Kenneth

Hi, i feel that i noticed you visited my weblog

thus i got here to return the choose?.I am attempting to in finding

issues to enhance my website!I guess its good enough to use

some of your ideas!!

My web page :: 꼭노

Louvenia

Hello just wanted to give you a brief heads up and let you

know a few of the images aren’t loading properly. I’m not sure why

but I think its a linking issue. I’ve tried

it in two different web browsers and both show the same outcome.

my web blog; situs slot toto

Trudy

Hmm is anyone else encountering problems with the pictures on this blog loading?

I’m trying to determine if its a problem on my end or if it’s the blog.

Any feed-back would be greatly appreciated.

Look into my blog post; https://arabbaloot.org/

Matilda

I am genuinely grateful to the holder of this website who has shared this

fantastic paragraph at here.

Also visit my page; sugar defender

Derick

Nice post. I was checking constantly this blog and I am impressed!

Very useful info specifically the last part :

) I care for such information much. I was seeking this particular information for a very long time.

Thank you and best of luck.

Here is my web-site Black Friday

Vince

Quality content is the important to be a focus for the people to visit the website,

that’s what this site is providing.

My site … 출장마사지

RodneyBow

скачать казино brillx

brillx казино

Как никогда прежде, в 2023 году Brillx Казино предоставляет широкий выбор увлекательных игровых автоматов, которые подарят вам незабываемые моменты радости и адреналина. С нами вы сможете насладиться великолепной графикой, захватывающими сюжетами и щедрыми выплатами. Бриллкс казино разнообразит ваш досуг, окунув вас в мир волнения и возможностей!Не пропустите шанс испытать удачу на официальном сайте бриллкс казино. Это место, где мечты сбываются и желания оживают. Станьте частью азартного влечения, которое не знает границ. Вас ждут невероятные призы, захватывающие турниры и море адреналина.

JefferyMiz

bs2web – blacksprut com ссылка, blacksprut онион

AnthonyFet

знаю что вроде прикольный

cardano, launched in this year, is a third-generation blockchain platform, which is aimed at lighting complexities of scalability, interoperability, use of https://www.1001expeditions.fr/comment-conduire-sur-lile-de-la-reunion/ and sustainable development.

Leonora

I’m not that much of a internet reader to be honest but your blogs really nice, keep it up!

I’ll go ahead and bookmark your site to come back in the

future. Many thanks

Feel free to visit my web site – Организатор Дня Рождения

Eloy

Hurrah! At last I got a website from where I know how to truly obtain valuable information regarding

my study and knowledge.

Look at my web-site 대구출장마사지

Albertina

After I originally commented I seem to have clicked

on the -Notify me when new comments are added- checkbox and from now on each time a comment

is added I get four emails with the same comment.

There has to be an easy method you can remove me from that service?

Appreciate it!

Look at my homepage … Raja Slot

Daniellab

bs2shop9.at – bs2site.at, bs2shop9.at

JamesVieni

Декларация соответствия Техническому регламенту Таможенного союза (ТР ТС) – это нормативный документ, официально подтверждающий соответствие заявленного продукта всем требованиям технических регламентов Таможенного союза ЕАЭС. Быстрое оформление – декларация соответствия тр тс.

BobbyDob

my website jaxx wallet download

Kennethwhert

кракен сайт kr2web in – кракен тор, kraken 13at

travel size lubricant

Specifically, which one of these hexes sounds best?

https://niu.sandianyixian.com

cctv batam

Mʏ programmer іs trying to persuade me to move to .net from PHP.

I have always disliked the idea because оf tthe еxpenses.

But һe’s tryiong none the less. I’ve been սszіng WordPress on a number of websіtes for

ɑbout a year and am worried aboսt switching to another platform.

I have heard good things abouut blogengine.net. Is there a way I can import all my wordpress posts into it?

Any help would be greatⅼy appreciated! https://online-learning-initiative.org/wiki/index.php/Rekomendasi_Cctv_Batam_Tanpa_Tali_Besi_Menyertai_Harga_Serta_Keistimewaannya

Fabian

I am extremely inspired together with your writing talents

and also with the format in your weblog. Is that this a paid subject matter or did you

customize it yourself? Anyway stay up the excellent quality writing,

it’s rare to look a nice blog like this one nowadays..

Also visit my page; лицензионные игры

Joeann

Hey! I just wanted tο aѕk іf you ever һave any problems witһ hackers?

My ⅼast blog (wordpress) wass hacked аnd

I endеd up losing a few monthѕ of hard work due to no baⅽk up.

Do you һave ɑny methods tto prevent hackers?

Review mʏ web рage: https://www.bangspankxxx.com

Gina

Hi I am so happy I found your site, I really

found you by mistake, while I was looking on Google for something else, Regardless I am

here now and would just like to say cheers for a tremendous post

and a all round thrilling blog (I also love the theme/design), I

don’t have time to look over it all at the moment but I have saved it and also included your RSS feeds, so when I have time I

will be back to read a great deal more, Please do keep up the fantastic job.

Here is my blog post: cryptocurrency copy trading

Marisa

Thanks for finally writing about > The Simple Investing Formula

– Round Box Equity < Liked it!

my page 강인경

Lourdes

“ТеплоТехник” предоставляет услуги инженерной сантехники, включая монтаж и

обслуживание. Мы гарантируем высокое качество работы и надежность всех систем.

Evan

Thanks in favor of sharing such a nice opinion, piece of writing is pleasant, thats why i have

read it fully

My homepage: 수원출장안마

Sherryl

Decide funding for the upcoming motor vehicle or refinance

with self esteem. Take a look at currently’s car financial

loan costs.

Time for you to first payment: After you offer a product, anticipate a

wait duration of all-around 5 times to get money within your checking account

on most platforms.

There’s no justification for working away from money any more.

Nicely, many of us mess up in some cases, but there’s no purpose you shouldn’t

be able to conjure up a couple of hundred dollars away from slender air for those who’re prepared to get Inventive regarding how to

make money.

Not everyone seems to be courageous adequate to hire out their total residence to your stranger,

but even leasing out the spare space can offer a large supply

of excess money. You may perhaps meet some attention-grabbing individuals

and find yourself enjoying it.

In the same way, if you’ve attained past success on the

planet of entrepreneurialism, your services could be of use to budding business people as well

as established business people who want to consider their organization to the subsequent amount.

Everybody knows that therapy is actually a hugely-expert and hard occupation, although not Lots

of people realize it’s shifting online.

A different crucial element of promoting and advertising

is casino starting off a good email promoting system, which helps to keep customers and change

prospects.

You may also make money fast by completing surveys, microtasks, rewards plans, or any of the other simple tips on this checklist.

The quantity you’ll get won’t be high, but It’ll be quick.

In addition to supporting organizations to deal with their

social accounts, you’ll be able to give them advice regarding how

to sort a protracted-expression social websites strategy.

Should you aren’t excited about working with a pc all day, Check

out a lot of the finest methods to make money offline:

Engaging in liable gambling with bonus resources and managing them as authentic money can cause greater determination-making along with

a simpler reward system.

Choose in for bonus resources. As many as 50x wagering, recreation contributions differ,

max. stake applies, new customers will have to decide in and claim offer in just 24 hrs and use inside thirty

days. Geographical Limits and T&Cs

I’m not sure if it’s intentional or an editorial remark, though the

pitch for blogging claims “Is there a topic or subject matter

you’re really experienced about and luxuriate in adequate to have

the ability to create on it each day For some time?

That compensation impacts the location and buy by which the manufacturers are offered and

is some scenarios may impression the rating that may be assigned to them.

MONEY

FREE CASH

CASINO

PORN

SEX

ONLY FANS

Edmundo

First of all I want to say wonderful blog! I had a quick question in which I’d

like to ask if you do not mind. I was interested to find out how

you center yourself and clear your mind before writing. I’ve

had trouble clearing my mind in getting my thoughts out.

I do enjoy writing but it just seems like the first 10 to 15 minutes are

lost just trying to figure out how to begin. Any recommendations or tips?

Thanks!

my web-site BJ노출

Frieda

Sᴡeet blоg! I found itt while searching on Yahoo News.

Do yоu have ɑny sսggestionns on how to get ⅼisted in Yahoo News?

I’vе been trying for a while bսt I never

seem to gett there! Cheers

My page: informasi selanjutnya

Jamie

Everyone loves what you guys are up too. Such clever work and coverage!

Keep up the good works guys I’ve incorporated you guys

to our blogroll.

my blog post – Antoine Legros

Damion

Attractive element of content. I jᥙѕt stumbled սpon your

weblog ɑnd iin accession capital to assert that I gеt actually enjoyed account уouг

blog posts. Ꭺny ԝay I’ll be subscribing to yօur augment ⲟr

eѵen I achievement y᧐u get admission to consistently rapidly.

Мy webpage :: Salimbet Link Login Alternatif

Christa

Hi friends, how is all, and what you desire to say regarding this paragraph, in my view its genuinely remarkable

in support of me.

Here is my web-site; 21 blackjack

Tania

I know this web page provides quality depending content and other stuff, is there any other web page which gives such things in quality?

Feel free to surf to my web page :: Заказать мухоморы

Magaret

I believe what you posted was very logical. But,

what about this? suppose you added a little information? I

mean, I don’t wish to tell you how to run your website,

however suppose you added a post title that makes people desire more?

I mean The Simple Investing Formula – Round

Box Equity is a little boring. You ought to peek at Yahoo’s front page and watch how they create article headlines to grab viewers interested.

You might add a video or a picture or two to get readers excited about

everything’ve got to say. In my opinion, it would make your posts a little livelier.

Also visit my website: https://www.cucumber7.com/

Melvin

What’s up, always i used to check website posts here early

in the dawn, because i like to learn more and more.

My website – 검증사이트

Chet

The managed service provider is responsible for the functionality of the service or equipment, managed

under a service level agreement .

Also visit my website; https://devread.net/scaling-it-support-strategies-for-growing-businesses

Jesusodors

изначально догадался..

in the year of writing this materials according to created by us estimates, more coins are traded on the international market 2 million pairs consisting of coins, https://crazyhorsecampgroundsaz.com/faded-dreams/ tokens and projects.

Rochell

An interesting discussion is worth comment. I do think that you should write more about this subject

matter, it may not be a taboo matter but typically people

don’t speak about such subjects. To the next! Kind regards!!

Visit my web page :: situs porno

Tangela

In recent years, the landscape off online gambling has undergone unprecedented growth,

with nations across the globe embracing this innovative gaming experience.

The Philippines has riisen ass a significant force in this expanding

market, presenting a diverse range of online casino options

to both naive and global players. Aidst this competitive landscape, Panaloko Casino has carved out a niche as a top-tier hub for players desiring an unparalleled online

gambling adventure.

In this comprehensive guide, we will examnine the diverse elements that establish Panaloko a preferred option for casino enthusiasts in the Philippines and

around thhe world. From iits extensive portfolio of games to its cutting-edge

safety protocols, we’ll uncover tthe reasons panalokio (500px.com)

Online Casino has become a well-known brand in the Philippine online gambling scene.

The Emergence of Online Casinos in the Philippines

Before delving into the specifics of Panaloko Casino,

it’s crucial to grasp the landscape of online gambling in the Philippines.

The country has a diverse and multifaceted legacy with gaming,

tracing its roots to pre-colonial times. However, it

wasn’t until the 1970s and 1980s that modern casino gamijng

started to emerge in the nation.

Thee advent of digital platforms heralded a revolutionary phase for gaming in the Philippines.

Several years ago, the country’s gaming regulator (PAGCOR) established tthe Philippine Offshore Gaming Operator (POGO) regulatory framework,

that allowed internet-based gambling platforms to conduct business within the country.

This move created opportunities for Filipino aand global compamies tto penetrate tthe

digital gaming landscape in the Philippines. Consequently,

the sectpr has witnessed exponential growth, woth various online

casinos vying for customer loyalty.

Presenting Panaloko Online Casino

Among this thriving ecosystem, Panaloko Online Casino has surfaced aas

a standout player. Launched in the past decade, Panaloko Casino has raapidly

earned a reputation for its devotion to providing a premium online

gambling journey adapted to the preferences of Pinoy gamblers.

The name “Panaloko” onn its own caarries meaning in local parlance.

Rooted in thhe vernacular term “panalo,” which signifies

“win” or “victory,” Panaloko Online Casino represents the spirit of achiefement that countless enthusiasts chae in their online

gaming experiences.

Portfolio of Games

One oof the key factors that differentiates Panaloko Online

Casino apart fom its competitors is its comprehensive sselection of

titles. Thhe plkatform boasts a wide-ranging portfolio of gambling

activities crfted to cater to the tastes of various gambling enthusiasts, fro inexperienced

bettoes to veteran players.

Slot Games

Pabaloko Online Casino’s one-armed bandit assortment

is nothing short of impressive. With a multitude of games

on offer, gamblers can experiesnce a range spanning traditional

three-reel slots too cutting-edge video slots

with immersive themes and enticing extra elements.

Among the fan-favorite slot otions on Panaloko Online Casino feature:

Mega Moolah

Galactic Riches

Book of Dead

Gonzo’s Quest

Vampire’s Kiss

These titles provide varying levels of riosk and prospective winnings, ensuring that choices are available for every type of player.

Traditional Gambling Options

For those who prefer more traditional casino experiences, Panaloko offers a wide range of traditional

favorites. Among these are:

Vingt-et-Un: Various versions of thhis timeless gambling activity are accessible,

such as European Blackjack, Multi-Hand Blackjack.

The Wheel of Fortune: Players can try their luck at various versioms of roulette, wkth each providing uniqque betting

options.

Pumto Banco: This sophisticated card game, preferred by luxury gamblers, is avaulable in several formats.

Poker: Numerous poker variants are available, including Caribbean Stud, Let It Ride.

Bones: This exhilarating dice game presents players the chance to partake iin the thrill of a betting venue from the convenience of their own living spaces.

Interactive Gambling Experiences

A keyy attraction off Panaloko Online Casino is its real-time gaming collection. These games blends the

convenience of online gambling with the

realism of a physical gambling establishment.

Gamblsrs can engage with trained croupiers in instantaneous through advanced streaming technology.

This ccreates an immersive environment that faithfully reproduces the feel of

playing in a physical casino.

In-demand live dealler options on Panaloko Casino feature:

Real-Time 21

Live Roulette

Interactive Chemin de Fer

Interactive Casino Hold’em

Interactive Unique Experiences: Including Deal or No Deal Live

Website Navigation

Panaloko lays a high priority on providing an outstanding website navigation. The website

is crafted with intuitive navigationn in mind, allowing

users to easily access their desired options and browse the different categories of the casino.

The design is modern and easy to navigate, with clear categories

for various gambling options. A powerful search functkon enables players to swiftly discover desired options

or try unfamiliar titles bassd on their preferences.

Additionally, Panaloko Casino has invested heavily in securing that its online casino is

fully responsive, offering a smooth transition acroxs multiple gadgets, like lptop machines,

handheld devices, and portable screens.

Mobile Gaming

Understanding the increasing popularity of portable betting, Panaloko haas developed a cutting-edge portable gaming solution that enables players

to enjoy

RobertHig

blog link counterwallet

Juan

I am actually grateful to the owner of this web site who has shared this great post at at this

time.

Take a look at my website :: https://bbs.pku.edu.cn

Alycia

What’s up, always i used to check web site posts here early in the

break of day, because i enjoy to learn more and more.

Also visit my homepage: 789win

Josef

Do you mind if I quote a few of your articles as long as I provide credit and sources back to your webpage?

My blog is in the very same area of interest as

yours and my visitors would certainly benefit from some of the information you provide here.

Please let me know if this okay with you. Thank you!

Take a look at my page; 8day

Johnette

Do you mind if I quote a few of your posts as long as I provide credit and

sources back to your weblog? My blog site is in the very same niche as

yours and my visitors would definitely benefit from some of the information you

present here. Please let me know if this okay with you.

Thanks!

My website m1bar.com

Alison

Every weekend i used to pay a quick visit this website, because i wish for

enjoyment, since this this site conations actually fastidious funny data too.

Have a look at my web page :: https://Www.Google.ci/url?q=https://digitaltibetan.Win/Wiki/Post:Ensuring_Safety_with_Diesel_Generators_A_Comprehensive_Analysis

Dolores

Hey There. I found your blog using msn. This is a really well written article.

I will make sure to bookmark it and come back to read more of

your useful info. Thanks for the post. I will certainly return.

My web blog Create realistic faces

Christiane

Hi there it’s me, I am also visiting this web page regularly, this web site is

genuinely pleasant and the viewers are really sharing fastidious thoughts.

Here is my web blog … login bandar55

Roger

This post is priceless. When can I find out more?

Here is my web page … slot dana

Felix

great points altogether, you simply received

a new reader. What may you suggest about your submit that you

made some days ago? Any sure?

my web-site: 먹튀검증

Mora

Hi there to every one, it’s genuinely a pleasant for me to visit

this website, it consists of valuable Information.

Also visit my webpage הזמנת חשפניות: עם החברה שלנו

Cindi

Hello very cool site!! Guy .. Beautiful .. Superb ..

I will bookmark your blog and take the feeds also? I’m glad to search

out numerous useful info right here in the submit, we want work out extra strategies on this regard, thanks for sharing.

. . . . .

Here is my website: Crypto SEO

King

Your mode of describing everything in this post is actually fastidious, every one can simply

be aware of it, Thanks a lot.

Also visit my web site Hefeiyechang.Com

Vida

This page really has all of the info I wanted concerning this subject and didn’t know who to ask.

Also visit my site; Emergency Electrician Services

Lara

Howdy would you mind letting me know which web host you’re utilizing?

I’ve loaded your blog in 3 different browsers and I must say

this blog loads a lot quicker then most. Can you

recommend a good hosting provider at a honest price?

Thanks, I appreciate it!

Feel free to visit my website – 인천출장마사지

Bernard

I was extremely pleased to find this website. I need to to

thank you for ones time for this fantastic read!!

I definitely liked every bit of it and I have you bookmarked to

check out new information in your blog.

Feel free to surf to my web site; Black Screen 5

Stuart

Heya i’m for the primary time here. I found this board

and I find It truly useful & it helped me out a

lot. I hope to present something back and aid others such as you helped me.

Feel free to visit my page :: Images.Google.Ms

Deloris

Hi, Neat post. There’s a problem with your web site in web explorer, may

check this? IE nonetheless is the marketplace leader and a big part of folks will miss

your magnificent writing due to this problem.

Review my webpage :: работа на дому

Felicia

Hello it’s me, I am also visiting this site regularly, this

website is truly pleasant and the users are really

sharing pleasant thoughts.

My web page … Casino SEO

Ewan

This iѕ а good tip particularly to thosxe new tо thе blogosphere.

Brіef Ьut vеry precise infօrmation… Thɑnk you

for sharing tһis one. A mmust read article!

Feel free tߋ surf tοo my blog post: Pena Slot

Raul

What’s up i am kavin, its my first occasion to commenting anywhere,

when i read this article i thought i could also make comment due to this brilliant piece of

writing.

Also visit my page; memek

Lemuel

Hi! This post could not be written any better!

Reading this post reminds me of my good old room mate!

He always kept chatting about this. I will forward this article

to him. Pretty sure he will have a good read. Thank you for sharing!

Here is my web page – безлимитный мобильный интернет

Maricruz

Amazing blog! Is your theme custom made or did you download it from somewhere?

A theme like yours with a few simple tweeks would really make my blog jump out.

Please let me know where you got your design. Kudos

My site … 검증사이트

Dougmix

Вот так история!

most banks themselves do not offer services for the exchange of cryptocurrencies and can do without cooperation with https://www.blogradardenoticias.com.br/contato/ companies.

Agustin

Good article. I am facing many of these issues as well..

Also visit my website SEO Denver

Travis

Hello just wanted to give you a brief heads up and let you know a few of

the pictures aren’t loading correctly. I’m not

sure why but I think its a linking issue. I’ve tried it

in two different internet browsers and both show the same results.

Also visit my blog post سیب بت

Arlene

I just could not go away your web site before suggesting that I extremely loved the

standard information an individual supply to your visitors?

Is gonna be back regularly in order to check up on new posts

Here is my blog post เว็บบทความ

Ricardoclide

здесь https://bs2site.uk/

Adan

Hello, i feel that i noticed you visited my site

so i got here to return the want?.I’m trying to in finding

issues to improve my website!I assume its ok to use some of

your concepts!!

Feel free to surf to my web-site ngentot anak

Caitlyn

What’s up, everything is going nicely here and ofcourse every one

is sharing information, that’s actually excellent, keep up writing.

my web site … 영등포 마사지

Thad

Thank you for the good writeup. It in truth was once a amusement account it.

Glance advanced to far delivered agreeable from

you! By the way, how can we be in contact?

Also visit my web page :: Crazy Time 1WIN, Tel,

Florentina

Hi, its pleasant paragraph regarding media print, we all be aware of media is

a fantastic source of facts.

Have a look at my web blog; 咖啡师学院

Kerrie

buy viagra online

RodneyBow

brillx регистрация

https://brillx-kazino.com

Brillx Казино – это не только великолепный ассортимент игр, но и высокий уровень сервиса. Наша команда профессионалов заботится о каждом игроке, обеспечивая полную поддержку и честную игру. На нашем сайте брилкс казино вы найдете не только классические слоты, но и уникальные вариации игр, созданные специально для вас.Brillx Казино — ваш уникальный путь к захватывающему миру азартных игр в 2023 году! Если вы ищете надежное онлайн-казино, которое сочетает в себе захватывающий геймплей и возможность играть как бесплатно, так и на деньги, то Брилкс Казино — идеальное место для вас. Опыт непревзойденной азартной атмосферы, где каждый спин, каждая ставка — это шанс на большой выигрыш, ждет вас прямо сейчас на Brillx Казино!

BruceSom

содержание https://bs2best.uk/

Bettie

We absolutely love your blog and find nearly all of your

post’s to be just what I’m looking for. Do

you offer guest writers to write content to suit your needs?

I wouldn’t mind writing a post or elaborating on a

lot of the subjects you write related to here. Again, awesome weblog!

My webpage: 비아약국

Ronda

When I initially commented I clicked the “Notify me when new comments are added” checkbox

and now each time a comment is added I get three e-mails with

the same comment. Is there any way you can remove me from that service?

Thanks!

my web site :: memek

RodneyBow

скачать казино brillx

https://brillx-kazino.com

Так что не упустите свой шанс — зайдите на официальный сайт Brillx Казино прямо сейчас, и погрузитесь в захватывающий мир азартных игр вместе с нами! Бриллкс казино ждет вас с открытыми объятиями, чтобы подарить незабываемые эмоции и шанс на невероятные выигрыши. Сделайте свою игру еще ярче и удачливее — играйте на Brillx Казино!Добро пожаловать в захватывающий мир азарта и возможностей на официальном сайте казино Brillx в 2023 году! Если вы ищете источник невероятной развлекательности, где можно играть онлайн бесплатно или за деньги в захватывающие игровые аппараты, то ваш поиск завершается здесь.

Mauricio

bookmarked!!, I love your web site!

My website kontol

Hulbartsnozy

You suggested that very well.

canadian pharmacy viagra reviews discount online canadian pharmacy best over the counter ed treatment

Reynaldo

Does your site have a contact page? I’m having problems locating it but, I’d like

to shoot you an email. I’ve got some recommendations for your blog you might be interested in hearing.

Either way, great site and I look forward to seeing it grow over time.

Also visit my blog: Real estate lawyer

RodneyBow

brillx casino

бриллкс

В 2023 году Brillx предлагает совершенно новые уровни азарта. Мы гордимся тем, что привносим инновации в каждый аспект игрового процесса. Наши разработчики работают над уникальными и захватывающими играми, которые вы не найдете больше нигде. От момента входа на сайт до момента, когда вы выигрываете крупную сумму на наших аппаратах, вы будете окружены неповторимой атмосферой удовольствия и удачи.Добро пожаловать в захватывающий мир азарта и возможностей на официальном сайте казино Brillx в 2023 году! Если вы ищете источник невероятной развлекательности, где можно играть онлайн бесплатно или за деньги в захватывающие игровые аппараты, то ваш поиск завершается здесь.

GelarGek

https://olimpzerkalo.top/ – как скачать и установить бесплатную версию приложения БК Олимп и наслаждайтесь ставками на спорт без дополнительных затрат.

Samual

My brother recommended I might like this website.

He was entirely right. This post truly made my day.

You cann’t imagine just how much time I had spent for this

info! Thanks!

Here is my web blog :: kontol

Charline

CBD and THC have many of the same medical benefits.

The average cannabis strain before 2014 contained about 12 percent

THC. Journal of Cannabis Research. Journal of General Internal Medicine.

Journal of Pain and Symptom Management. Check

the product label for dose instructions and suggested usage.

They deliver an authentic cannabis taste, a powerful dose of CBD, and a full-bodied throat

hit that cannabis lovers are sure to enjoy.

Most standard drug tests will look for chemicals related to

THC, so THC or cannabis use might appear on a screening.

The plant produces a resin that contains several

substances or chemicals. The cannabis plant contains the cannabinoid CBD.

Hempified CBD Gummies oil may contain small amounts of THC because it’s present at

low levels in the hemp plant. Likewise, hemp can produce

some THC in addition to CBD, so a test could be positive for THC even if

you haven’t used it.

Teri

Excellent post. I will be going through many of these issues as

well..

Look into my page :: what is the meaning of cryptocurrency

RodneyBow

brillx официальный сайт

бриллкс

Brillx Казино – это не только великолепный ассортимент игр, но и высокий уровень сервиса. Наша команда профессионалов заботится о каждом игроке, обеспечивая полную поддержку и честную игру. На нашем сайте брилкс казино вы найдете не только классические слоты, но и уникальные вариации игр, созданные специально для вас.Брилкс Казино – это небывалая возможность погрузиться в атмосферу роскоши и азарта. Каждая деталь сайта продумана до мельчайших нюансов, чтобы обеспечить вам комфортное и захватывающее игровое пространство. На страницах Brillx Казино вы найдете множество увлекательных игровых аппаратов, которые подарят вам эмоции, сравнимые только с реальной азартной столицей.

RodneyBow

brillx официальный сайт

https://brillx-kazino.com

Играя в Brillx Казино, вы окунетесь в мир невероятных возможностей. Наши игровые автоматы не только приносят удовольствие, но и дарят шанс выиграть крупные денежные призы. Ведь настоящий азарт – это когда каждое вращение может изменить вашу жизнь!Вас ждет огромный выбор игровых аппаратов, способных удовлетворить даже самых изысканных игроков. Брилкс Казино знает, как удивить вас каждым спином. Насладитесь блеском и сиянием наших игр, ведь каждый слот — это как бриллиант, который только ждет своего обладателя. Неважно, играете ли вы ради веселья или стремитесь поймать удачу за хвост и выиграть крупный куш, Brillx сделает все возможное, чтобы удовлетворить ваши азартные желания.

RodneyBow

бриллкс

Brillx

Brillx Казино – это не только великолепный ассортимент игр, но и высокий уровень сервиса. Наша команда профессионалов заботится о каждом игроке, обеспечивая полную поддержку и честную игру. На нашем сайте брилкс казино вы найдете не только классические слоты, но и уникальные вариации игр, созданные специально для вас.Бриллкс казино в 2023 году предоставляет невероятные возможности для всех азартных любителей. Вы можете играть онлайн бесплатно или испытать удачу на деньги — выбор за вами. От популярных слотов до классических карточных игр, здесь есть все, чтобы удовлетворить даже самого искушенного игрока.

Hulbartsnozy

Seriously tons of superb tips!

walgreen pharmacy hours by store india online pharmacy 1 canadian pharmacy

Luann

Heya i’m for the first time here. I found this board and I to find It truly helpful & it helped me out much.

I’m hoping to provide one thing back and aid others like you aided

me.

my web-site; techtunes auto

RodneyBow

брилкс казино

https://brillx-kazino.com

Но если вы готовы испытать настоящий азарт и почувствовать вкус победы, то регистрация на Brillx Казино откроет вам доступ к захватывающему миру игр на деньги. Сделайте свои ставки, и каждый спин превратится в захватывающее приключение, где удача и мастерство сплетаются в уникальную симфонию успеха!Но если вы ищете большее, чем просто весело провести время, Brillx Казино дает вам возможность играть на деньги. Наши игровые аппараты – это не только средство развлечения, но и потенциальный источник невероятных доходов. Бриллкс Казино сотрясает стереотипы и вносит свежий ветер в мир азартных игр.

Audry

I was recommended this web site by my cousin. I am not

sure whether this post is written by him as nobody else know such detailed about my problem.

You are incredible! Thanks!

Here is my website – Wongqq

Joesph

I read this post completely concerning the comparison of most recent and preceding technologies,

it’s remarkable article.

my blog post :: Visit here

RodneyBow

brillx казино

бриллкс

Как никогда прежде, в 2023 году Brillx Казино предоставляет широкий выбор увлекательных игровых автоматов, которые подарят вам незабываемые моменты радости и адреналина. С нами вы сможете насладиться великолепной графикой, захватывающими сюжетами и щедрыми выплатами. Бриллкс казино разнообразит ваш досуг, окунув вас в мир волнения и возможностей!Играя на Brillx Казино, вы можете быть уверены в честности и безопасности своих данных. Мы используем передовые технологии для защиты информации наших игроков, так что вы можете сосредоточиться исключительно на игре и наслаждаться процессом без каких-либо сомнений или опасений.

Senaida

You are so cool! I do not think I’ve read through

something like this before. So good to find someone with

some genuine thoughts on this subject. Really..

thanks for starting this up. This web site is one thing that is required

on the internet, someone with some originality!

My webpage Vyvanse For Sale

Bonita

Howdy! This is kind of off topic but I need some help from an established blog.

Is it hard to set up your own blog? I’m not very techincal but I can figure things out pretty quick.

I’m thinking about setting up my own but I’m not sure where to begin. Do you have any points or suggestions?

Cheers

Here is my webpage :: Main profile

RitaCrack

Я хорошо разбираюсь в этом. Могу помочь в решении вопроса.

Why is technology – block chain important for cryptocurrencies? at that hour as bitcoin today remains most well-known http://mkfoundryconsulting.com/hello-world-2/, and most other cryptocurrencies do not give a speculative impact, investors and users should pay gaze to such cryptocurrencies.

Faye

Thank you a lot for sharing this with all of us you really understand what you’re

speaking approximately! Bookmarked. Please additionally seek advice from

my site =). We could have a hyperlink exchange arrangement between us

Review my web site; 서울출장안마

RodneyBow

brillx casino официальный мобильная версия

https://brillx-kazino.com

Сияющие огни бриллкс казино приветствуют вас в уникальной атмосфере азартных развлечений. В 2023 году мы рады предложить вам возможность играть онлайн бесплатно или на деньги в самые захватывающие игровые аппараты. Наши эксклюзивные игры станут вашим партнером в незабываемом приключении, где каждое вращение барабанов приносит невероятные эмоции.Добро пожаловать в мир азарта и возможностей на официальном сайте Brillx Казино! Здесь, в 2023 году, ваш шанс на удачу преумножается с каждым вращением барабанов игровых аппаратов. Brillx — это не просто казино, это уникальное путешествие в мир азартных развлечений.

Catharine

international money transfer

Great weblog here! Additionally your site quite a bit up very fast!

What host are you the usage of? Can I am getting your affiliate hyperlink on your host?

I wish my site loaded up as fast as yours lol

RodneyBow

brillx casino

Brillx

Добро пожаловать в захватывающий мир азарта и возможностей на официальном сайте казино Brillx в 2023 году! Если вы ищете источник невероятной развлекательности, где можно играть онлайн бесплатно или за деньги в захватывающие игровые аппараты, то ваш поиск завершается здесь.Brillx Казино – это не только великолепный ассортимент игр, но и высокий уровень сервиса. Наша команда профессионалов заботится о каждом игроке, обеспечивая полную поддержку и честную игру. На нашем сайте брилкс казино вы найдете не только классические слоты, но и уникальные вариации игр, созданные специально для вас.

Etsuko

It is the best time to make a few plans for the long run and it is time

to be happy. I have read this publish and if I may just I want to

recommend you some attention-grabbing issues or tips.

Perhaps you could write next articles referring to this article.

I desire to read more issues approximately it!

My web site :: zwoltek01

August

It’s great that you are getting ideas from this post as well as from our dialogue made at this time.

my blog post – employment law lawyers

RodneyBow

brillx регистрация

brillx казино

Бриллкс казино в 2023 году предоставляет невероятные возможности для всех азартных любителей. Вы можете играть онлайн бесплатно или испытать удачу на деньги — выбор за вами. От популярных слотов до классических карточных игр, здесь есть все, чтобы удовлетворить даже самого искушенного игрока.Добро пожаловать в мир азарта и возможностей на официальном сайте Brillx Казино! Здесь, в 2023 году, ваш шанс на удачу преумножается с каждым вращением барабанов игровых аппаратов. Brillx — это не просто казино, это уникальное путешествие в мир азартных развлечений.

Bryanric

First up your account and get MORE!

Regardless of your budget, we suffer with an astounding extend in the course of you!

Leave any amount up to $400 and get a HONORARIUM of 100-120% of your keep amount!

Monotonous if you don’t include a overweight amount, you can stock-still spread your entrust and enjoy more fun while playing!

Take a shot it absolute any longer and start playing with leftover funds in your account!

Your winnings are waiting in support of you!

https://shorturl.at/V1G8d

ラブドール オナニー

https://www.kireidoll.com/tpe-real-sex-doll-2386.html

Shawnemich

loli

==> xzy.cz/2333 wts.la/wfelq <==

Kandis

I am genuinely grateful to the owner of this

web page who has shared this great post at here.

Look at my webpage teething baby ashburn va

WilliamMut

Основа сео-копирайтинга – это, ординарно, ключевики, по каковым поисковая система будет отыскивать заметку в зависимости от набранного в поисковой строке вопроса. Всегда имеется 3 варианта “кейвордов” (:

1. Конкретное вхождение в текстовую часть.

2. Предложение.

3. Разбавление.

Рассмотрим их всего подробнее, употребляя настоящий прототип ключевика “ткани для жилья”.